According to the provisions provided under Rule 41 of the Central Goods and Services Tax (CGST) Rules, 2017 related to “Transfer of Input Tax Credit (ITC) on Sale, Merger, Amalgamation, Lease or Transfer of a Business”, are as under:

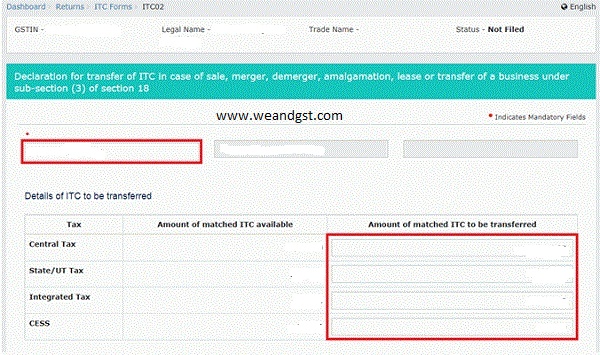

(1) A registered person shall, in the event of sale, merger, de-merger, amalgamation, lease or transfer or change in the ownership of business for any reason, furnish the details of sale, merger, de-merger, amalgamation, lease or transfer of business, in FORM GST ITC-02, electronically on the common portal along with a request for transfer of un-utilized input tax credit lying in his electronic credit ledger to the transferee :

Transfer of Input Tax Credit : Form ITC 02

Provided that in the case of Demerger, the input tax credit shall be apportioned in the ratio of the value of assets of the new units as specified in the demerger scheme.

(2) The transferor shall also submit a copy of a certificate issued by a practicing chartered accountant or cost accountant certifying that the sale, merger, de-merger, amalgamation, lease or transfer of business has been done with a specific provision for the transfer of liabilities.

(3) The transferee shall, on the common portal, accept the details so furnished by the transferor and, upon such acceptance, the un-utilized credit specified in FORM GST ITC-02shall be credited to his electronic credit ledger.

(4) The inputs and capital goods so transferred shall be duly accounted for by the transferee in his books of account.

Amendments

The CBIC vide Notification No. 16/2019 –Central Tax dated 29thMarch, 2019 has provided the amendments in Rule 41 of CGST Act 2017,

In the Central Goods and Services Tax Rules, 2017 (hereinafter referred to as the said rules), in rule 41, in sub-rule (1), after the proviso, the following explanation shall be inserted, namely: –

“Explanation: -For the purpose of this sub-rule, it is hereby clarified that the “Value of Assets” means the value of the entire assets of the business,whether or not input tax credit has been availed thereon.