Time of Supply in GST

Time of Supply: In order to calculate and discharge tax liability it is important to know the date when the tax liability arises i.e. the date on which the charging event has occurred. In GST law, it is known as Time of Supply. GST law has provided separate provisions to determine the time of supply of goods and time of supply of services. Sections 12, 13 & 14 of the CGST Act, 2017, deals with the provisions related to the time of supply and by virtue of section 20 of the IGST Act, 2017, these provisions are also applicable to inter-State supplies leviable to Integrated tax.

Point of time when supplier receives the payment or date of receipt of payment The phrase “the date on which supplier receives the payment” or “the date of receipt of payment” means the date on which payment is entered in books of accounts of the supplier or the date on which the payment is credited to his bank account, whichever is earlier.

Time of issue of invoice for supply

As per section 31 of the CGST Act, 2017 an invoice for the supply of goods needs to be issued before or at the time of removal of goods for supply to the recipient where the supply involves the movement of goods. However, in other

cases, invoice needs to be issued before or at the time of delivery of goods or making available goods to the recipient.

Similarly, an invoice for the supply of services needs to be issued before or after the provision of service but not later than thirty days from the date of provision of service.

Time of supply of goods (Default Rule)

Earliest of the following dates

• Date of issue of the invoice by the supplier. If the invoice is not issued, then the last date on which supplier

is legally bound to issue the invoice with respect to the supply.

• Date on which supplier receives the payment. Section 148 of the CGST Act, 2017, confers powers on the government (on the recommendation of the GST Council) to notify certain classes of registered persons and the special procedures to be followed by such persons including those with regard to registration, the furnishing of return, payment of tax and administration of such persons. In exercise of powers conferred by this section, the government on the recommendations of the GST Council has notified the registered persons (who have not opted for composition levy) as the class of persons who shall pay GST on the outward supply of goods at the time of supply specified in clause (a) of sub-section (2) of Section 12. Thus, in respect of supply of goods by normal registered persons (other than composition dealers), the time of supply will be the issue of invoice (or the last date by which invoice has to be issued in terms of Section 31) Therefore, all taxpayers (except composition taxpayers) are exempted from paying GST at the time of receipt of advance in relation to supply of goods. The entire GST shall be payable only when the invoice is issued for such supply of goods. The special procedure will be applicable to this class of persons (registered persons making supplies of goods other than composition dealers) even in situations governed by Section 14 of the Act (change in rate). Notification no. 66/2017-Central Tax dated 15.11.2017 may be referred to.

Time of supply of services (Default Rule)

Earliest of the following dates

• If the invoice is issued within the legally prescribed period under section 31(2) of the CGST Act, 2017 read with Rule 47 of CGST Rules, 2017 (which is thirty days from the date of the supply of service), then the date of issue of invoice by the supplier or date of receipt of payment, whichever is earlier.

• If the invoice is not issued within the legally prescribed period under section 31(2) of the CGST Act, 2017 then the date of provision of service or date of receipt of payment, whichever is earlier.

• Date on which recipient shows the receipt of service in his books of account, in a case aforesaid two provisions, do not apply.

The supply of services shall be deemed to have been made to the extent it is covered by the invoice or by the payment, as the case may be. For example, Firm ‘A’ receives an advance of Rs. 2500/- on 29.07.2017 for provision of services worth Rs. 10000/- to be supplied in the month of September, then it is deemed that firm ‘A’ has made a supply of Rs. 2500/- on 29.07.2017 and tax liability on Rs. 2500/- is to be discharged by 20.08.2017. Although tax is payable on any advance received for a supply of services, however for the convenience of trade it is provided that if a supplier of taxable services receives an amount up to Rs. 1000/- in excess of the amount indicated on the tax invoice, then the supplier has an option to take the date of issue of the invoice in respect of such supply as time of supply. For example, if a supplier has received an amount of Rs. 1500/- against an invoice of Rs.1100/- on 25.07.2017 and date of invoice of next supply to the said recipient is 14.08.2017, then he has option to treat the time of supply w.r.t Rs. 400/- either as 25.07.2017 or 14.08.2017.

Time of supply of goods when tax is to be paid on reverse charge basis

Earliest of the following dates

• Date of receipt of goods

• Date on which payment is entered in the books of accounts of the recipient or the date on which the

payment is debited in his bank account, whichever is earlier.

• Date immediately following 30 days from the date of issue of invoice or any other legal document in

lieu of invoice by the supplier.

However, if it is not possible to determine the time of supply in an aforesaid manner then the time of supply is the

date of entry of the transaction in the books of accounts of the recipient of supply.

Time of supply of services when tax is to be paid on reverse charge basis

Earliest of the following dates

• Date of payment as entered in the books of account of the recipient or the date on which the payment

is debited in his bank account, whichever is earlier

• Date immediately following 60 days from the date of issue of invoice or any other legal document in

lieu of invoice by the supplier.

However, if it is not possible to determine the time of supply in an aforesaid manner then the time of supply is the

date of entry of the transaction in the books of accounts of the recipient of the supply.

Time of supply of services in case of supply by Associated Enterprises located outside India

In this case, the time of supply is the date of entry in the books of account of the recipient or the date of payment,

whichever is earlier.

Time of supply in case of supply of vouchers

Voucher has been defined in the CGST Act, 2017 as an instrument where there is an obligation to accept it as

consideration or part consideration for a supply of goods or services or both and where the goods or services or both

to be supplied or the identities of their potential suppliers are either indicated on the instrument itself or in related

documentation, including the terms and conditions of use of such instrument. Vouchers are commonly used for

transaction in the Indian economy. A shopkeeper may issue vouchers for specific supply i.e. supply is identifiable at the time of issuance of the voucher. In trade parlance, these are known as single purpose vouchers.

For example, vouchers for pressure cookers or Television or for spa or haircut. Similarly, a voucher can be general purpose voucher which can be used for multiple purposes.

For example, a Rs.1000/- voucher issued by Shoppers’ Stop store can be used for buying any product at any Shoppes’ Stop store.

Time of supply is different in case of the single-purpose voucher and in the case of general purpose voucher.

Time of supply in the case of the single-purpose voucher i.e. case where supply is identifiable at the time of issuance of the voucher is date of issue of voucher. However, in all other cases of supply of vouchers, time of supply is date of

redemption of voucher.

Time of supply of goods or services (Residual provisions)

In case it is not possible to determine the time of supply under aforesaid provisions, the time of supply is,-

• Due date of filing of return, in case where periodical return has to be filed

• Date of payment of tax in all other cases.

Time of supply of goods or services related to an addition in the value of supply by way of interest, late fees or penalty

Time of supply related to an addition in the value of supply by way of interest, late fee or penalty for delayed payment

of any consideration shall be the date on which suppliers receives such addition in value. For example a supplier

receives consideration in the month of September instead of due date of July and for such delay he is eligible to

receive an interest amount of Rs. 1000/- and said amount is received on 15.12.2017. The time of supply of such amount (Rs. 1000/-) will be the 15.12.2017 i.e. the date on which it is received by the supplier and tax liability on this is to be discharged by 20.01.2018.

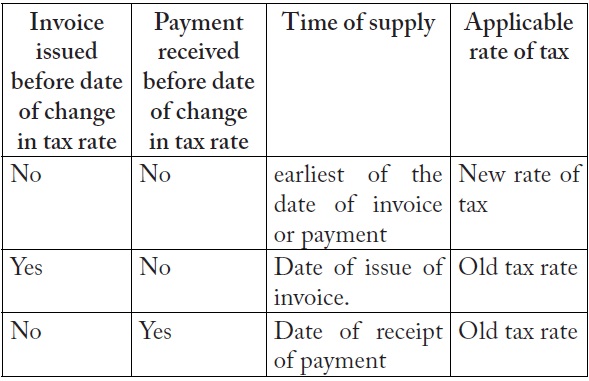

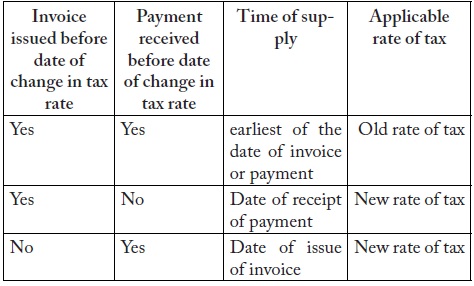

Change in Rate of Tax in respect of supply of goods or services

Where there is a change in rate of tax of supply of goods or services, time of supply has to be determined in the

following manner:-

Supply is completed before the change in rate of tax

Supply is completed after the change in rate of tax

However, the special procedure for payment of tax by suppliers of goods (other than composition dealers) notified

by Government vide notification no. 66/2017-Central Tax dated 15.11.2017 under section 148 of the CGST Act, 2017, will continue to govern even in the above situation.

In a nutshell, suppliers of goods other than composition dealers will have to pay tax at the time of issue of invoice

only. Date of receipt of Payment in case of the change in the rate of tax Normally the date of receipt of payment is the date of credit in the bank account of the recipient of payment or the date on which the payment is entered into his books of account, whichever is earlier. Further, the date of credit in the bank account is relevant if such credit is after four working days from the date of change in rate of tax.

Permalink