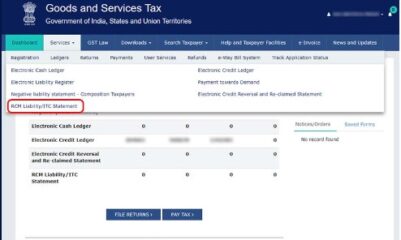

Introduction of RCM Liability/ITC Statement

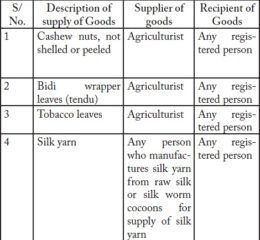

Reading Time: 2 minutesRCM Liability/ITC Statement, In the matter of correctly reporting Reverse Charge Mechanism (RCM) transactions, a new statement called “RCM Liability/ITC Statement“ has been introduced on the GST Portal. This statement will enhance accuracy and transparency for RCM transactions by capturing the RCM liability shown in Table 3.1(d) of GSTR-3B and its corresponding ITC claimed in Table

Read More