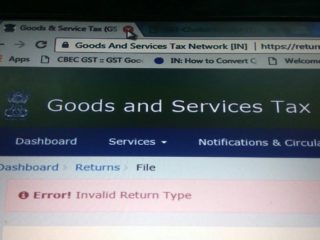

Govt extends April GST payment deadline till May 24, 2022

Reading Time: < 1 minuteThe Central Board of Indirect Taxes and Customs (CBIC) said a technical glitch has been reported by Infosys in the generation of April 2022 GSTR-2B and auto-population of GSTR-3B on the portal. The due date for filing FORM GSTR-3B for the month of April 2022 has been extended to 24th May 2022 (refer to notification

Read More