Notification regarding Rectification of Omissions, Errors during filing of GST Return

Reading Time: < 1 minuteNotification regarding Rectification of Omissions, Errors during filing of GST Return GST Return circularno-26-cgst

Reading Time: < 1 minuteNotification regarding Rectification of Omissions, Errors during filing of GST Return GST Return circularno-26-cgst

Reading Time: 2 minutes GSTR2 : what should a recipient do on his GST return? A receiver taxpayer can do the following in his GSTR2. Analyse the supplier-wise summary of gstr2 all invoices uploaded by the suppliers Against each invoice of the supplier ,receiver taxpayer can tax can take one of four possible actions – Accept,Modify ,Reject and

Read More

Reading Time: < 1 minuteLast date for GSTR1 Filling for july 2017 #BreakingNews 10th Oct is the last date for filing your GSTR1. After 10th Oct, GSTR 1 will not be possible to be filed till 30th Oct , reports @askGSTech #GST #GSTSimplified #WeAndGST Image Credit @askGSTech

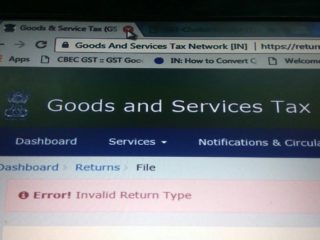

Reading Time: 2 minutesMany of Professionals are facing the “Error Invalid Return Type” ” in GSTR3B Return for as shown in the below image Solution It’s a minor problem and it’s can be fixed in few seconds. just follow the below mention step. To avoid getting this error, please click on the tile ‘Monthly Return GSTR 3B’ to

Read More