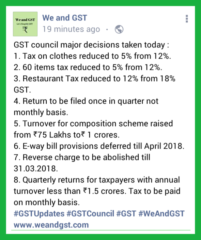

Recommendations made by 53rd GST council meeting

Reading Time: 2 minutesRecommendations made by 53rd GST council meeting held on 22nd June 2024 are as following;- 1. Waver of interest and penalty on demand notices issued under section 73 for FY 2017-18, 2018-19, 2019-20. Applicable in cases where tax is paid entirely by March 2025. 2. time limit to avail ITC u/s16(4) filed up to

Read More