Simplified Returns and Return Formats, The GST Council in its 27th meeting held on 4th May 2018 had approved the basic principles of GST return design. Now in its 28th meeting held on 21st July 2018, GST Council approved the key features and the new format of the GST returns. This document lists the salient features of the new return format and business process for seeking the feedback of trade and industry and other stakeholders. Please leave your feedback using this discussion forum on MyGov.in.

To facilitate the analysis of the comments/feedback, you are requested to please mention page numbers in your feedback. For example, #Page 26 – Suggestion. This will help us compile and analyse the feedback in a structured manner.

In case you have more than one suggestion to offer, you may find it convenient to type out your comments (with page nos.) in a separate document and upload the same. Simplified Returns and Return Formats

Part A: Key features of the Monthly Return:

1. Monthly Return and due-date

2. (i) Nil return:

(ii) Small taxpayers:

3. Continuous uploading and viewing

4. The due date for uploading invoices and action to be taken by the recipient:

5. Invoice uploaded but return not filed:

6. Unidirectional Flow of document

7. Missing invoice reporting

8. Offline IT Tool:

9. Payment of tax:

10. Recovery of input tax credit:

11. Locking of invoices

12. Rejected invoices:

13.Pending invoices

14. Deemed locking of invoices:

15. Unlocking of invoices

16. Amendment of invoices:

17. HSN:

18. Return format:

19. Payment of multiple liabilities:

20. Amendment return:

21. Amendment of missing invoices:

22. Amendment of details other than that of invoice:

23. Payment due to amended liability:

24. Negative Liability:

25. Higher late fee for amendment return:

26. Monthly Accounting:

27. Exports:

28. Transmission of data to ICEGATE:

29. The integrated flow of information:

30. Supply-side control:

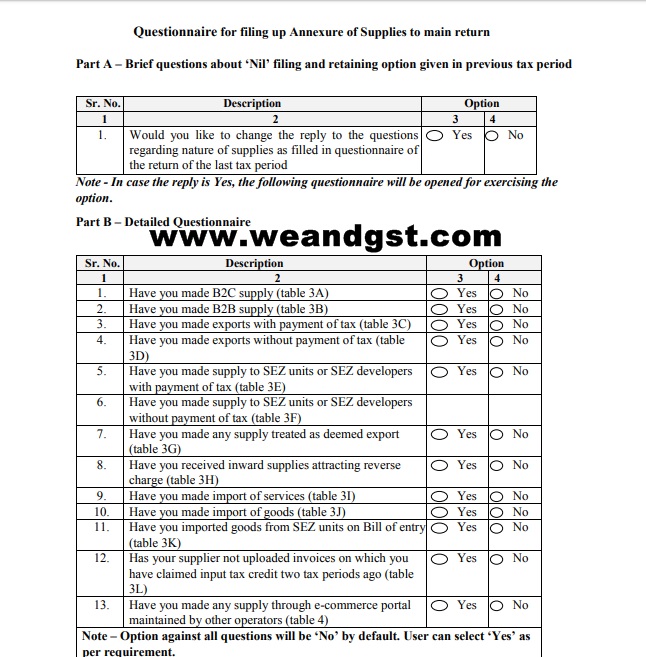

31. Profile-based return:

32. Purchase information in the annual return:

33. Suspension of registration:

34. Draft formats: Simplified Returns and Return Formats

Part B: Key features of Quarterly Returns:

1. Quarterly filing and monthly payments:

2. Quarterly or monthly return:

3. Options in quarterly return:

4. Quarterly Return:

5. Sahaj and Sugam Returns:

6. Uploading of invoices:

7. Payment declaration form for payment of monthly taxes:

8. Lower compliance cost:

9. HSN:

10. Pending and missing invoices:

11. Draft formats:

Simplified Returns and Return Formats