Latest Changes for GST Composition Dealers

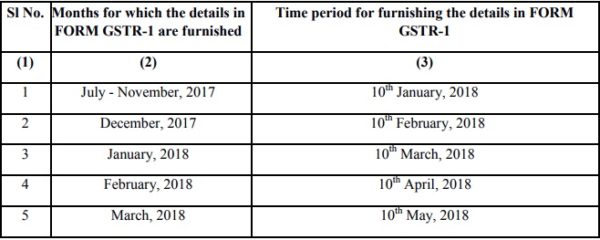

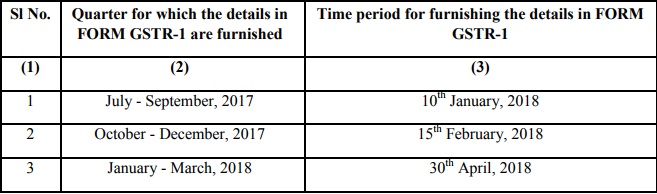

Reading Time: 2 minutesLatest Changes for GST Composition Dealers Two Important changes have been made for GST Composite Dealers w.e.f 1st January 2018 1 : Manufacturers under composition scheme had to pay 2% tax till now but from 1st January 2018, they will 1% GST .which included 0.50 % CGST and 0.50 % SGST. Thus the different Tax rate

Read More