Latest GST Frequently Asked Questions (FAQs) 2018

CBEC has issued a set of Latest GST Frequently Asked Questions (FAQs) 2018 It contains 24 chapters and 558 questions, updated as on 01 January 2018, the FAQs will continue to disseminate knowledge and

spread awareness on GST amongst the Tax officials, Trade and Public like gsp.

The first edition of Latest GST Frequently Asked Questions (GST FAQs ) was released on 21st September 2016 and The second edition of these GST FAQs was released on 31st March 2017

Few Latest GST Frequently Asked Questions (FAQs) 2018

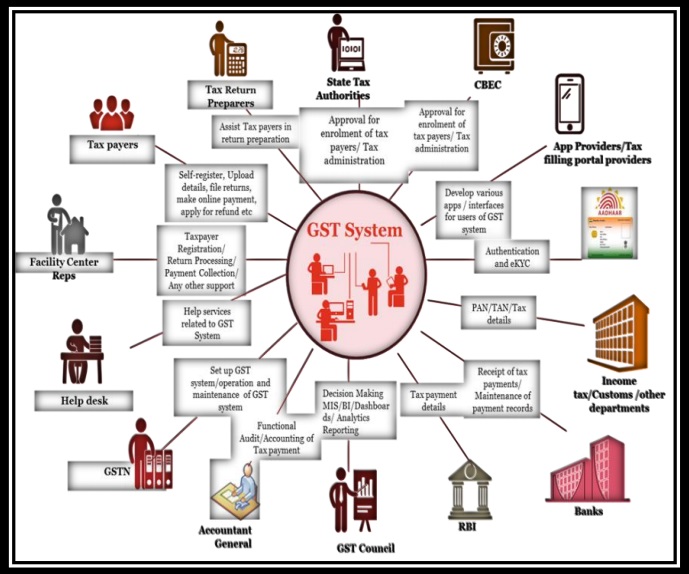

The concept of GST Eco-system

A common GST system will provide linkage to all State/UT Commercial Tax departments, Central Tax authorities, Taxpayers, Banks and other stakeholders. The ecosystem consists of all stakeholders starting from the taxpayer to tax professional to tax officials to GST portal to Banks to accounting authorities. The diagram given below depicts the whole GST eco-system.

GSP (GST Suvidha Provider)

GST System will provide a GST portal for taxpayers to access the GST System and do all the GST compliance activities. But there will be wide variety of taxpayers (SME, Large Enterprise, Micro Enterprise etc.) which may require different kind of facilities like converting their purchase/sales register data in GST compliant format, Integration of their Accounting Packages/ERP with GST System etc., various kind of dashboards to view Matched/Mismatched ITC claims, Tax liability, Filing status etc. As invoice level filing is required, so large organizations may require an automated way to interact with GST system as it may be practically impossible for them to upload a large number of invoices through a web portal. So an ecosystem is required, which can help such

taxpayers in GST compliance. As Taxpayer convenience will be the key to success of GST regime, this eco-system will also provide Taxpayer options of using third-party applications, which can provide a different kind of interfaces on desktop/mobile for them to be GST compliant.

All above reasons require an eco-system of the third party service providers, who have access to GST System and capability to develop such applications. These service providers have been given a generic name, GST Suvidha Providers or GSP

The role of GST Suvidha Providers (GSP)

GSP will be developing applications having features like return filing, reconciliation of purchase register data with auto-populated data for acceptance/rejection/Modification, dashboards for taxpayers for quick monitoring of GST compliance activities. they may also provide role-based access to divide various GST related activities like uploading invoice, filing returns etc., among a different set of users inside a company (medium or large companies will need it), Applications for Tax Professional to manage their client’s GST compliance activities, Integration of existing

accounting packages/ERP with GST System etc.

The benefits to taxpayers in using the GSPs

At the outset, it is clarified that all required functions under GST can be performed by a taxpayer at the GST portal. GSP is an additional channel being made available for performing some of the functions and use of their services is optional. Some of the specific solution(s) could be offered by the GSPs to meet specific requirements of Taxpayers for GST compliance are given below:

1. Conversion of their current invoice format generated by their existing accounting software, which could be in csv, pdf, excel, word format, into GST compliant format.

2. Reconciliation of auto-populated data from GST portal with their purchase register data, where purchase register data can be on excel, csv or in any proprietary database and uploaded data from GST format could be in json/csv.

3. The organization having various branches will need a way to upload branch wise invoices, as GST The system will only provide one user-id/password for GST system access. An application having role-based access and the different view for different branches will be needed.

4. A company registered in multiple States may require unified view of all branches in one screen,

5. GST professionals will need some specific applications to manage and undertake GST compliance activities for their client Taxpayers from one dashboard, etc. Above are just a few illustrations. There will be many more requirements of different sets of Taxpayers. These requirements of taxpayers can be met by GSPs.

to read the full set of Latest GST Frequently Asked Questions (FAQs) 2018 please read the notification

Latest GST Frequently Asked Questions faq-gst-2018

Permalink