Latest Changes in GSTR3B

GSTN have amended some steps of GSTR3B filing with effect from today, Government has made a lot of changes in GSTR 3B today. What it means is GSTR 3B will continue for a long time even after March 18. Otherwise, they would not have made these changes for a form to be filled for 2 months only.earlier it was declared that GSTR3B will no longer available after March 2018.

Following Changes have been done to the GSTR 3B online filing process by GSTN,

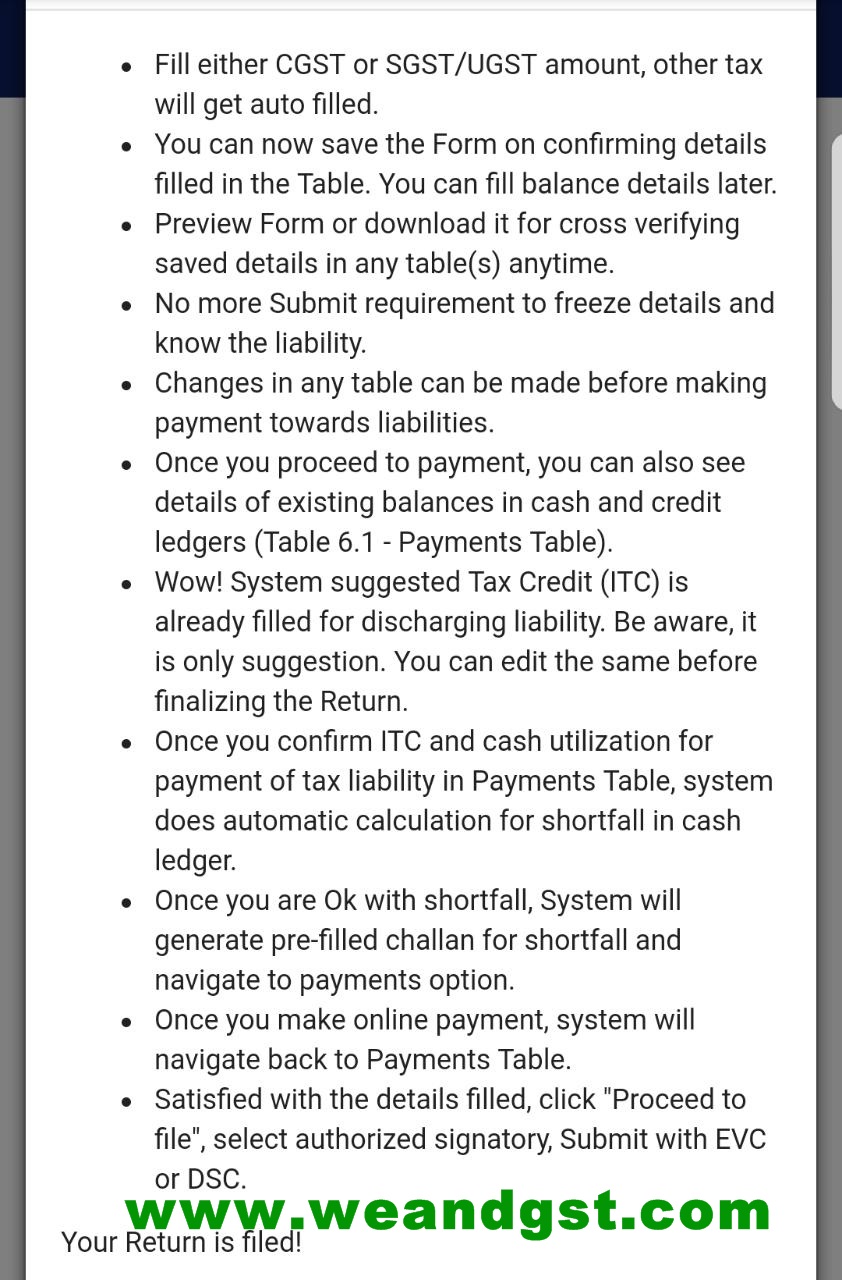

1) The user will have to Fill either CGST or SGST/UGST amount, other taxes columns will get auto-filled.

2) The user can now save the Form on confirming details filled in the Table. You can fill balance details later.

3) The user can Preview Form or download it for cross verifying saved details in any table(s) anytime.

4) For freezing the details and to know the liability, submit option is not required now.

5) Changes in any table can be made before making the payment towards liabilities.

6) Once you proceed to payment, you can also see details of existing balances in cash and credit ledgers (Table 6.1 – Payments Table).

7) The system suggested Tax Credit (ITC) is already filled for discharging liability. Be aware, it is only suggestion. You can edit the same before finalizing the Return.

8) Once you confirm ITC and cash utilization for payment of tax liability in Payments Table, the system does the automatic calculation for the shortfall in cash ledger.

9) Once you are Ok with the shortfall, System will generate pre-filled challan for the shortfall and navigate to payments option.

10) Once you make an online payment, the system will navigate back to Payments Table.

11) You can Track Return status as well as download the Return from through Track Return Status functionality available at your dashboard

You can Refer User Manual provided by GSTN for detailed steps for filing GSTR 3B