Income tax challan correction ,New Functionality for “Challan Correction” launched by income tax department

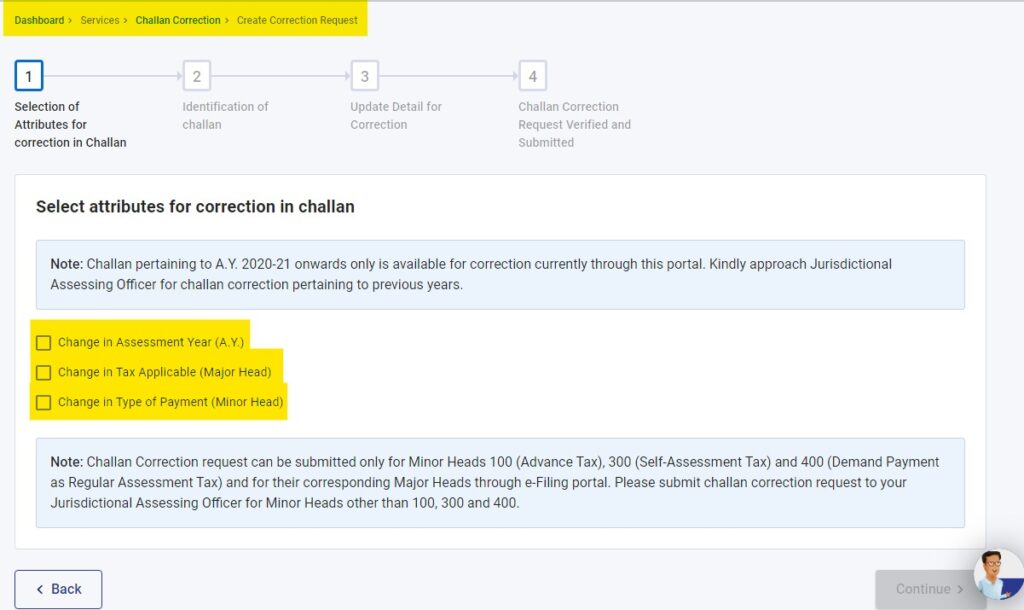

Using this Functionality you can Change Assesment Year, Major Head and Minor Head for Advance Tax, Self-Assessment Tax and Demand Payment as Regular Assessment Tax for Challan pertaining to A.Y. 2020-21 onwards within 7 days of tax payment.

Challan Correction request can be submitted only for Minor Heads 100 (Advance Tax), 300 (Self-Assessment Tax) and 400 (Demand Payment as Regular Assessment Tax) and for their corresponding Major Heads through e-Filing portal.

For any other type of correction, Kindly approach Jurisdictional Assessing Officer

Path for challan correction:

Dashboard > Services > Challan Correction

Earliest the Challan Correction mechanism was available on offline system, where the taxpayers required to approach the Bank or the tax authority with an application in an specific format.