GSTIN or Goods and Services Tax Identification Number is provided to normal taxpayers, casual taxable Entities and non-resident taxable Entities who register for GST. Likewise, GST Unique ID can be allotted by the GST Authorities. this article briefs the GST UIN (Unique Identification Number ).

GST UIN ( UID ) vs GSTIN

GSTIN ( Goods and Services Tax Identification Number ) is allotted to the regular taxable persons or entities who need to collect Goods and Service Tax and file GST returns. Likewise, GST UID (Unique Identification Number ) is exclusively provided to persons notified in the GST Act . Thus the GSTIN and GST UID are different forms for identify the taxable persons or entity registered under GST Regime.

Who can get GST UIN (UID)?

According to The GST Act ” An special agency of the UNO (United Nations Organisation ) or an Organization which is notified under the United Nations (Privileges and Immensities ) Act, 1947 i.e Multilateral Financial Institution and Organisation , Embassies and Consulates of foreign countries and any other Taxable Entities or Persons notified by the GST Commissioner can be granted a GST UID (GST Unique Identity Number).The Claim for GST Refund and Other functions can be made on GST Authority notified supplies of goods or services ”

How to apply for GST UIN?

GST UIN can be Provided to The Embassies/Consulates, Other Special Agencies as briefed above.

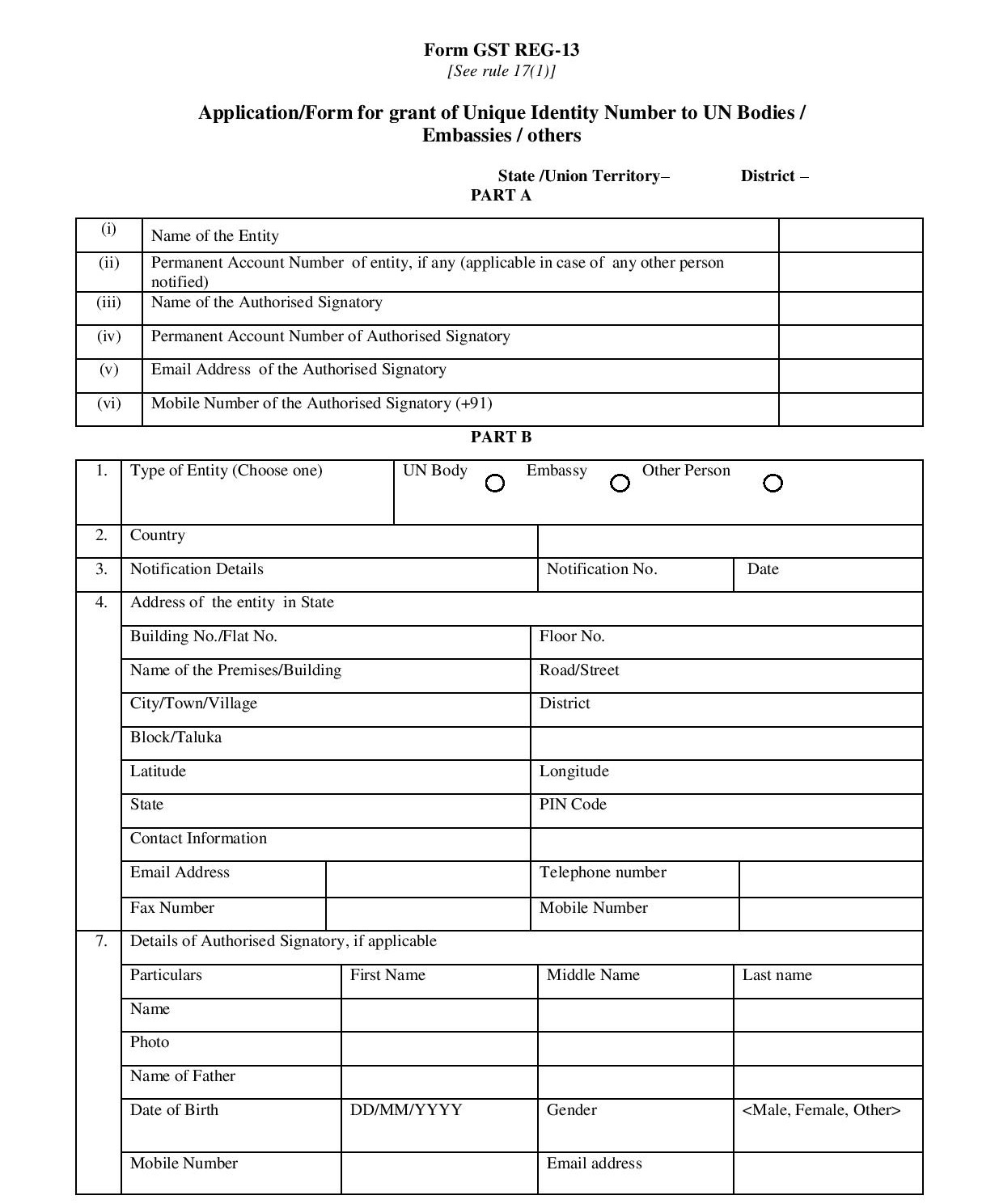

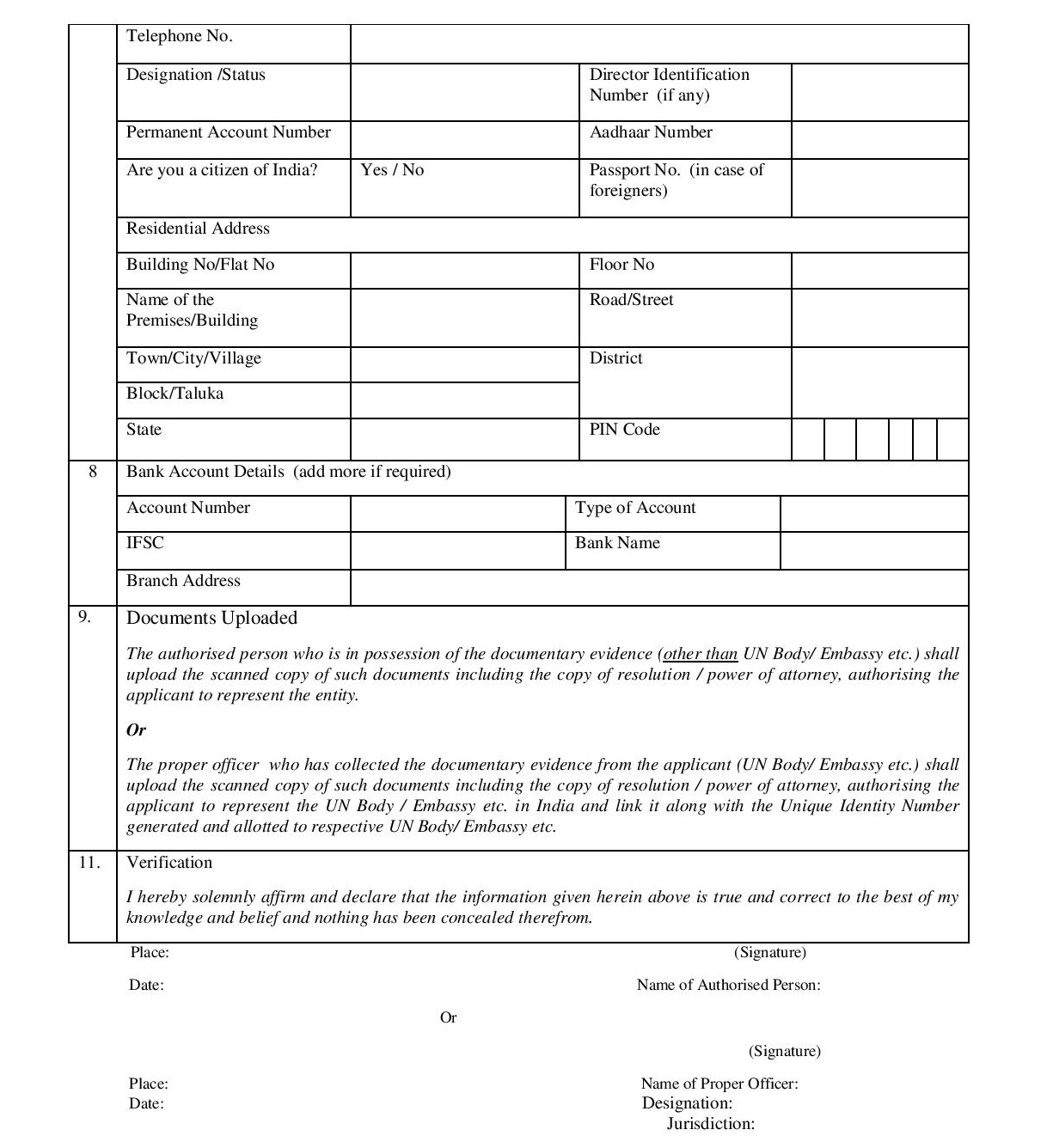

Form GST REG-13 is the application Form for GST UIN .

apart from the application for GST UIN as FORM REG-13 on the GST Common Portal, a Competent GST officer can also provide the GST UIN to the consulates and embassies on “Suo-Moto” Basis.

Time Limit for obtaining the GST UIN?

After receiving the application FORM GST REG-13 the Related GST office is required to issue a GST certificate in FORM GST REG-06 within a period of Three working days from the date of the submission of the application.

GST Return for GST UIN Holders

All Taxable persons having GST UIN are bound to file a GSTR-11 Return on Quarterly Basis.

GST refunds Based on the GSTR-11 return filings ,will be processed by the Government.

GSTR-11 cant be modified or allowed to changed by the UIN Holders and GST UIN Holders are required to verify and file Auto Populated GSTR-1

Download form-gst-reg-13

Disclaimer : All Information are given for education purpose user must verify the rules and regulations from government sources

Permalink