GST Registration for NRIs , Being Largest market for investment ,India always a fascinating country for non residents for business. if any non resident entity plans to start a business in India than GST registration is a must for him . here we discuss about GST provisions for non residents:-

List of Documents for GST Registration for NRIs

- Self Attested Passport Copy (In case of Individual )

- Tax Identity Proof (In Case of Business )

- PAN of Indian

- Photo of the Authorized Signatory (Indian)

- Proof of Appointment of Authorized Signatory (Any One of Below)

- Letter of Authorization

- Copy of Resolution passed by BoD/ Managing Committee and Acceptance letter

- Proof of Principal Place of business (Any One)

- Electricity Bill

- Legal ownership document

- Municipal Khata Copy

- Property Tax Receipt

- Rent / Lease agreement

- Rent receipt with NOC (In case of no/expired agreement)

- Proof of Details of Bank Accounts (Any One)

- First page of Pass Book/Bank Statement/Cancelled Cheque

- Estimated Turnover for which Tax would be deposited in Advance

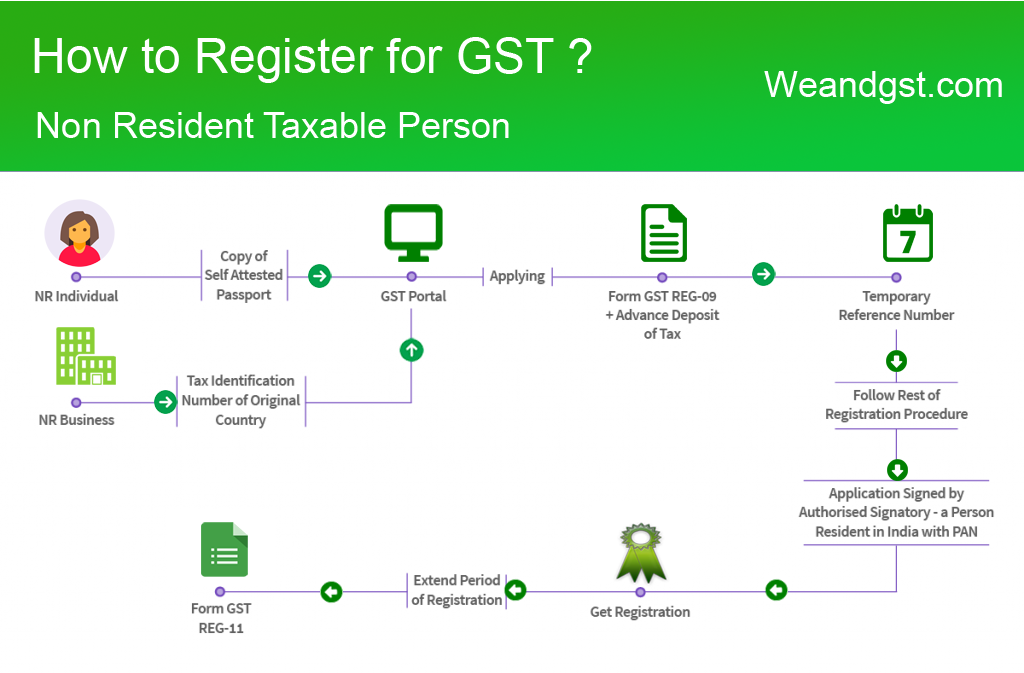

Lets discuss the process for GST registration for NRIs and related forms

Provisional Registration

- FORM GST REG-09 is to be electronically filed as application by a non resident taxable person ,with his self attested Passport copy.

- The application wil be signed or EVC verified

- The application can be filed five days before starting of business.

- Foreign Businesses which is incorporated or situated outside India ,the registration application must be filed with TAX IDENTIFICATION NUMBER of respective country ..

- Non resident taxable person needs to deposit an estimated amount as TAX with application.

Final Registration

Final registration process will be same as resident ,

- If the Taxable entity wishes to register under GST, then it will submit the electronic application using the FORM GST REG–26. all information must be furnished within three months.

- FORM GST REG-06 will be issued as the Final GST Registration if the given information found correct and complete .

- In case of wrong information ,The competent Authority will send a Show-Cause Notice i.e FORM GST REG-27 . the opportunity of Hearing will be provided and after that Provisional Registration will be cancelled wide FORM GST REG-28 .

- The Show-Cause Notice may be revoked wide FORM GST REG- 20 ,if the applicant gives a satisfactory reply .

- An Authorized Signatory who must be a resident Indian having valid PAN will sign the application for registration on behalf of a Non resident Entity .

Disclaimer : All the given information are for Educational Purpose only and user must verify the rules and regulations from government sources .

Permalink