GST on Farmers, The Central Board of Indirect Taxes & Customs has given Clarification on the GST implication related to farmers on 28th May 2018, according to the press release issued by CBIC

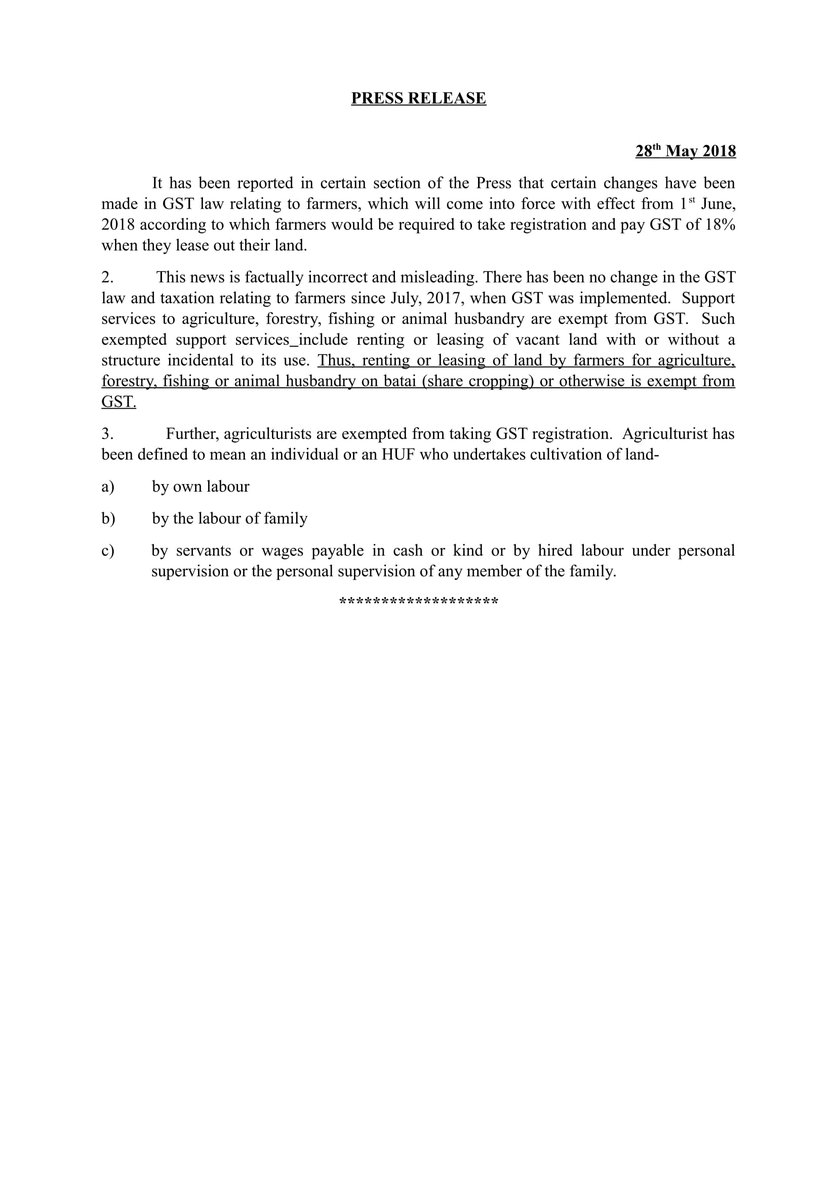

“It has been reported in the certain section of the Press that certain changes have been made in GST law relating to farmers, which will come into force with effect from 1st June 2018 according to which farmers would be required to take registration and pay GST of 18% when they lease out their land”.

GST on Farmers

2). This news is factually incorrect and misleading. There has been no change in the GST law and taxation relating to farmers since July 2017, when GST was implemented. Support services to agriculture, forestry, fishing or animal husbandry are exempt from GST. Such exempted support services include renting or leasing of vacant land with or without a structure incidental to its use. Thus. renting or leasing of land by farmers for agriculture. forestry, fishing or animal husbandry on Batai (share cropping) or otherwise is exempt from GST. GST on Farmers

3) Further, agriculturists are exempted from taking GST registration. Agriculturist has been defined to mean an individual or a HUF who undertakes cultivation of land-

a) By own labour,

b) By the labour of family

c) By servants or wages payable in cash or kind or by hired labour under personal supervision or the personal supervision Of any member Of the family. GST on Farmers

GST Relief for Farmers

After the 22nd GST Council Meeting scheduled on 6th October, the new tax rate on pump sets has been reduced to 18 percent from 28 percent. The reduction in tax rates in pumps will encourage the confidence level of pump makers in India and is beneficial for the agricultural industry. The market share of pumps in India is valued nearly at Rs 10,000 crores in the financial year of 2016 and it is anticipated that rise to 8 percent yearly over the coming years.

Permalink