GST common portal Latest updates

The GST portal has now more than one Crore taxpayers registered on it and more than six Crores returns have been filed on the portal. The overall percentage of return filing for July GSTR-3B is 93.3%, the same for August it stands at 89.05%. The percentile of GSTR-1 filing is much smaller than GSTR-3B filing. If you have not filed your return so far, please file it immediately to avoid payment of late fees and penal interest.

Given below is updated for you on functionalities which were made available on GST Portal in last fortnight:

(A) Returns:

Deemed Export details with payment of CGST and SGST can now be shown in Form GSTR-1.

Features in Form GST ITC-04 filing has been enhanced, to allow multiple entries of items covered by a single challah.

(B) Miscellaneous: A new feature has been added to the Pre-login search facility of Taxpayer on GST Portal. Now along with the taxpayer details and jurisdiction, last five returns filing status of taxpayers will also be available, in the pre-login search menu.

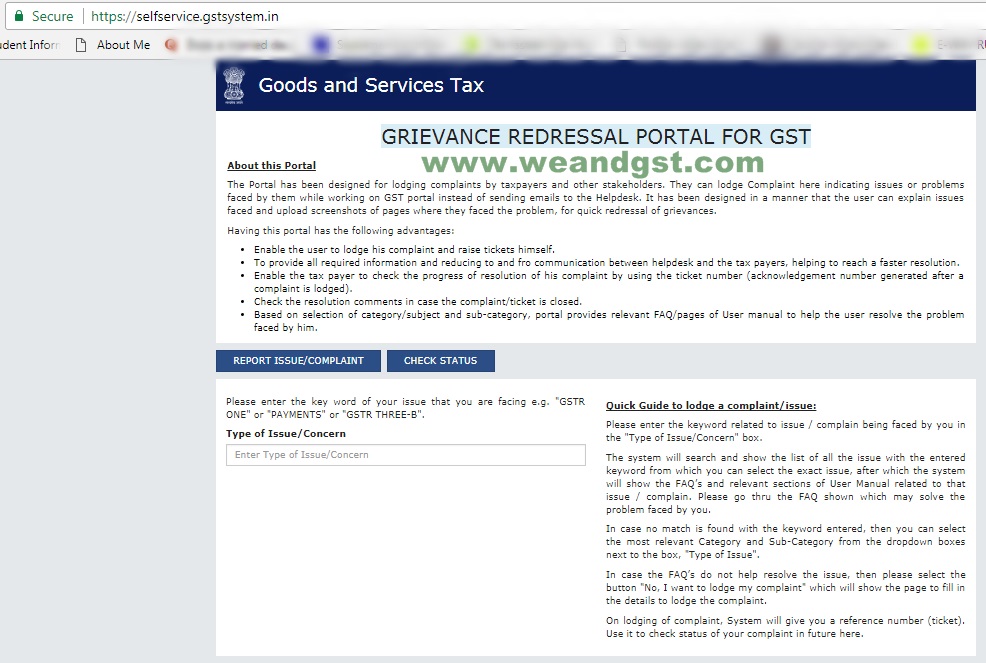

(C) New Grievance Portal :

A Grievance Portal has been designed for lodging complaints by taxpayers and other stakeholders instead of sending emails to the helpdesk.

Based on the selection of category/subject and sub-category, the portal provides relevant FAQ/pages of the User manual, to help user resolve the problem faced by them.

If that does not resolve the problem, the user can lodge a complaint on the portal, indicating issues or problems faced and upload screenshots where the problem is faced.

Portal generates acknowledgment (Ticket) which can be used to check the progress of resolution of the complaint.

The email id of GST helpdesk helpdesk@gst.gov.in has been discontinued.

The Grievance portal can be accessed at https://selfservice.gstsystem.in/.

This is for your information, please.

Thanking you,

Team GSTN

Disclaimer: the above mention information regarding GST common portal Latest updates have been released by GSTN