On high demand from taxpayers and consultants ,government of India has announced today that the Late Fee would be waived off for the dealers who had not furnished GSTR-3B return for August and September, 2017 by the due date.

The Finance Ministry Mr Arun Jaitly tweeted that “To facilitate taxpayers, late fee on filing of GSTR-3B for Aug&Sept has been waived. Late fee paid will be credited back to taxpayer ledger.”

The Government of India will not charge Late fee or penalty for late filing of GST returns during the interim period, Many tax payers complained that the Goods and Services Tax Network (GSTN) has started to auto populate penalty for late filing of GSTR 3B and this made people angry

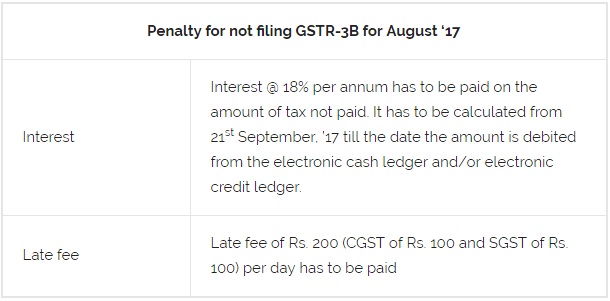

. As per GST laws, A penalty of Rs.100 per day is applicable for late filing of GST return. The penalty would be payable for the period in which the taxpayer failed to furnish the return up to a maximum penalty of Rs.5000. GSTR 3B will not be uploaded without paying the penalty.

The Government had also waived the late fee of July.