GSTN has informed the taxpayers that the functionality for geocoding the principal place of business address (i.e. the process of converting an address or description of a location into geographic coordinates) is now available on the GST Portal. The above-said feature is introduced to ensure the accuracy of address details in Goods and Services Tax Network (GSTN) records and streamline the address location and verification process.

This functionality can be accessed under the Services/Registration tab in the FO portal. The system-generated geocoded address will be displayed, and taxpayers can either accept it or update it as per the requirements of their case. In cases where the system-generated geocoded address is unavailable, a blank will be displayed, and taxpayers can directly update the geocoded address.

The geocoded address details will be saved separately under the “Principal Geocoded” tab on the portal. They can be viewed under My profile>>Place of Business tab under the heading “Principal Geocoded” after logging into the portal. It will not change your existing addresses.

Geocoding of Address of Principal Place of Business, please follow the below steps:

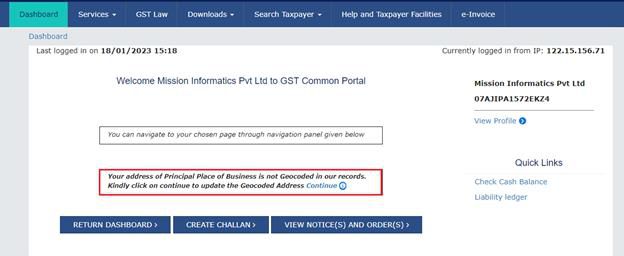

1. Access the https://www.gst.gov.in/ URL. Login to the GST Portal with your Username and

password.

2.1. After logging in, a message is displayed to all eligible taxpayers. Click on Continue to

Geocode your Principal Place of Business.

Note: This message will not be displayed for the users who have already geocoded their

address.

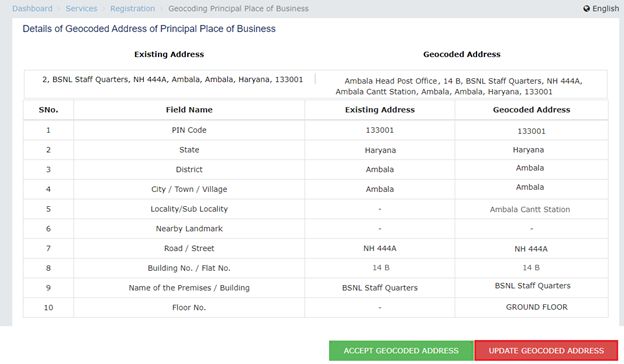

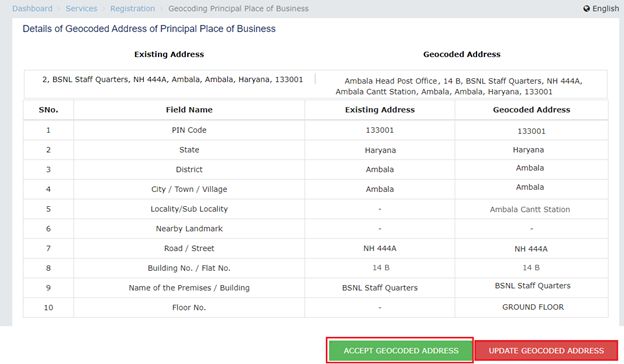

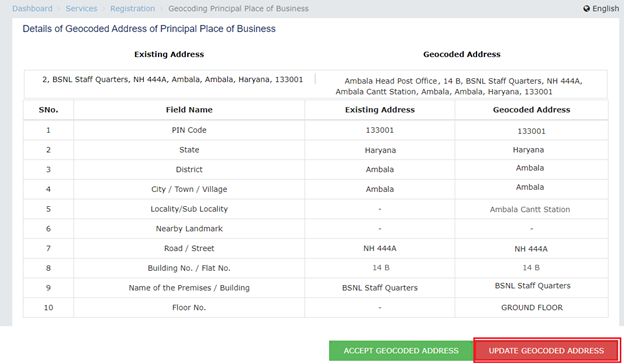

Details of Geocoded Address of Principal Place of Business page is displayed with details of your existing Principal Place of Business as per your registration details. Click on ACCEPT GEOCODED ADDRESS or UPDATE GEOCODED ADDRESS button to proceed.

A. ACCEPT GEOCODED ADDRESS

1. In case the address appearing in Geocoded Address column is correct, click on the ACCEPT GEOCODED ADDRESS button to accept the available Geocoded Address.

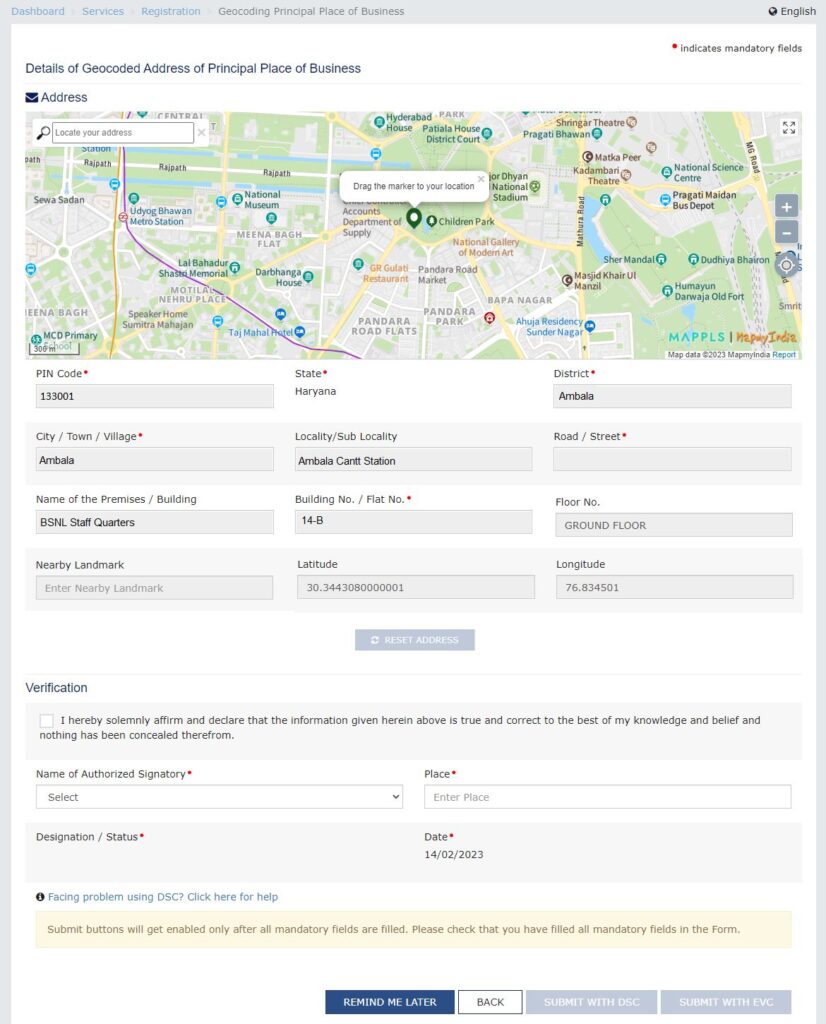

The Geocoded address of the Principal Place of Business accepted by the taxpayer is displayed in the fields appearing below the map. All relevant fields will be auto-populated and frozen, i.e., no changes would be allowed to be done by the taxpayer

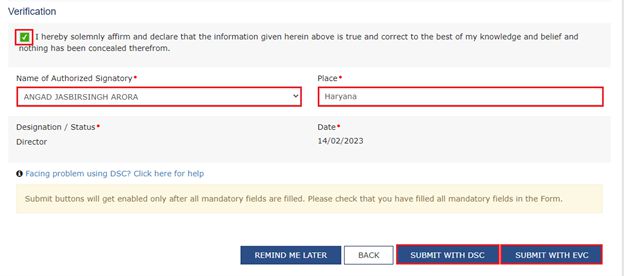

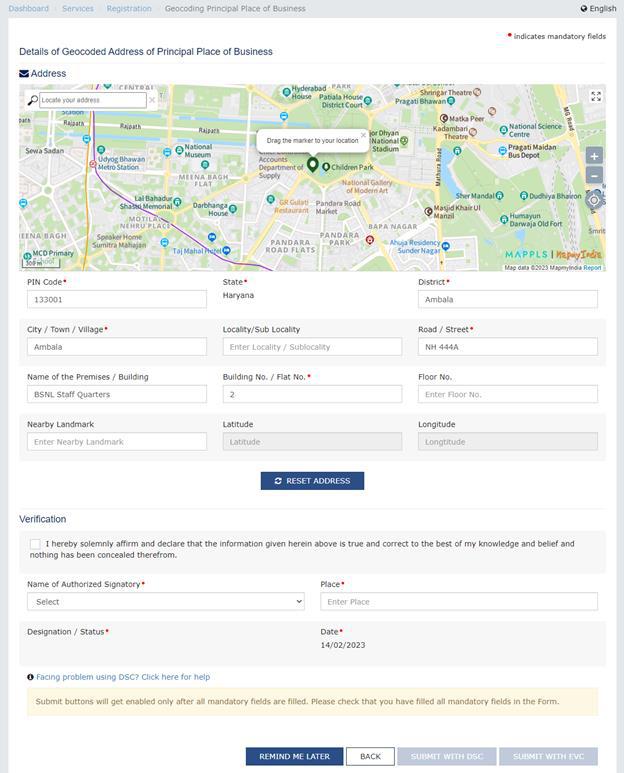

Select the Verification checkbox. Select the Name of Authorized Signatory from the dropdown list and enter the Place from where the application is being filed.

Click on SUBMIT WITH DSC or SUBMIT WITH EVC as applicable/ eligible.

Note: If you wish to complete this later you can click on Remind Me Later button.

5.1. In case of SUBMIT WITH DSC:

a. Click the SUBMIT WITH DSC button.

b. Click the PROCEED button.

c. Select the certificate and click the SIGN button.

5.2. In case of SUBMIT WITH EVC:

a. Click the SUBMIT WITH EVC button.

b. Enter the OTP sent to email and mobile number of the Authorized Signatory registered at the

GST Portal and click the VALIDATE OTP button.

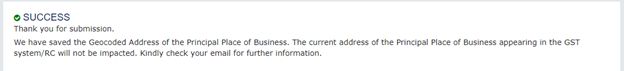

6. A success message is displayed. Intimation of the update is sent to the registered Email ID

and Mobile Number.

UPDATE GEOCODED ADDRESS

In case Geocoded Address is not available on screen or you are not in agreement with available Geocoded address, then you can click on the UPDATE GEOCODED ADDRESS button. You will be redirected to update your address.

The details of the existing Principal Place of Business as per the Registration details are displayed along with the Map above them

The geocoding link will not be visible on the portal once the geocoding details are submitted by the taxpayer. This is a one-time activity, and once submitted, revision in the address is not allowed and the functionality will not be visible to the taxpayers who have already geocoded their address through new registration or core amendment. GSTN emphasizes once again that the address appearing on the registration certificate can be changed only through the core amendment process. This geocoding functionality would not impact the previously saved address record.

This functionality is available for normal, composition, SEZ units, SEZ developers, ISD, and casual taxpayers who are active, canceled and suspended. It will gradually be opened for other types of taxpayers.

GSTN has also informed that this functionality is currently being made available for taxpayers registered in Delhi and Haryana only, and it will gradually be opened for taxpayers from other States and UTs.

Permalink //

sakhibpasha86@gmail.com

Permalink //

Iam from Karnataka state in Mysore district and my city is hunsur