FORM GST TRAN-1, The Central Board of Indirect taxes & Customs ( CBIC ) vide its Order No. 01/2019-GST dated January 31, 2019, extends the time limit for submitting the declaration in FORM GST TRAN-1 till March 31, 2019, for the class of registered persons who could not submit the said declaration by the due date on account of technical difficulties on the common portal and whose cases have been recommended by the Council.

F. No. CBEC-20/06/17/2018-GST

Government of India

Ministry of Finance

(Department of Revenue)

[Central Board of Indirect Taxes and Customs]

***

New Delhi, the 31st January 2019

Order No. 01/2019-GST

Subject: Extension of time limit for submitting the declaration in FORM GST TRAN-1 under rule 117(1 A) of the Central Goods and Service Tax Rules, 2017 in certain cases

In exercise of the powers conferred by sub-rule (1 A) of rule 117 of the Central Goods and Services Tax Rules, 2017 read with section 168 of the Central Goods and Services Tax Act, 2017, on the recommendations of the Council, and in suppression of Order No. 4/2018- GST dated 17.09.2018, except as respects things done or omitted to be done before such suppression, the Commissioner hereby extends the period for submitting the declaration in FORM GST TRAN-1 till 31st March, 2019, for the class of registered persons who could not submit the said declaration by the due date on account of technical difficulties on the common portal and whose cases have been recommended by the Council.

Read the official Order regarding GST TRAN-1

A Brief about the Form GST TRAN-1

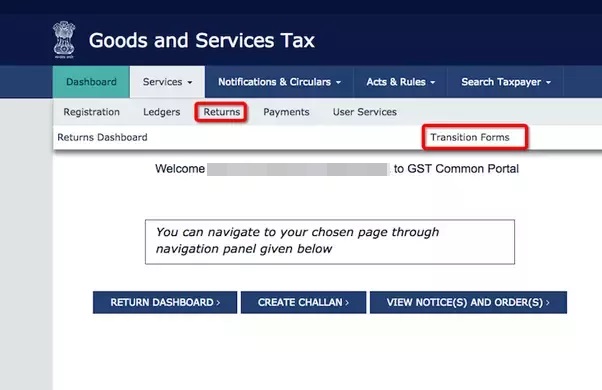

Goods and Services Tax Network (GSTN) had gone live with GST TRAN-1 Form. The taxpayers who have the Credit of input tax in previous tax regime of VAT/Service Tax/Excise Duty can file this return form along with the particulars of stock carried forward to claim the complete amount as a credit under GST. The taxpayer can file this return online by logging into GST common portal at https://www.gst.gov.in/