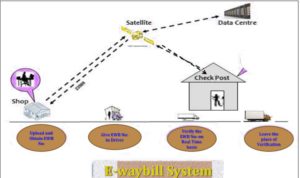

E Way Bill and it’s Process

What is E-Way Bill

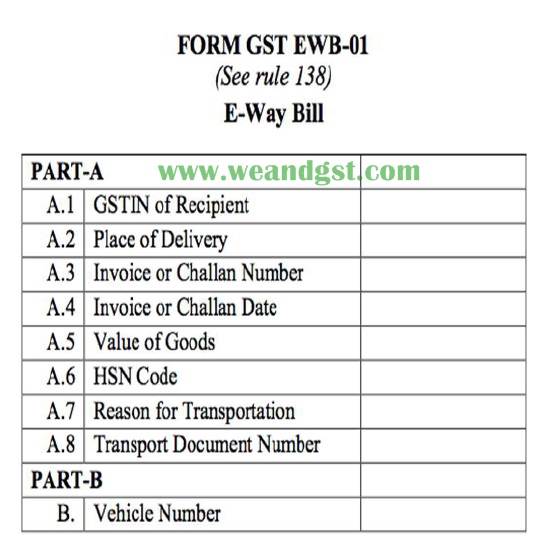

E-way bill (FORM GST EWB-01) is an electronic document available to supplier/ recipient/transporter) generated on the common portal evidencing movement of goods of consignment value more than Rs. 50000/-. It has two Components

•Part A comprising of details of GSTIN of recipient, place of delivery (PIN Code), invoice or challan number and date, value of goods, HSN code, transport document number (Goods Receipt Number or Railway Receipt Number or Airway Bill Number or Bill of Lading Number) and reasons for transportation; and

• Part B –comprising of transporter details (Vehicle number).

Generation of E-way Bill

Every registered person who causes movement of goods of consignment value exceeding fifty thousand rupees

- In relation to supply; or

- For reasons o/t supply; ( sales returns; stock transfer; movement for job work etc)

or - Due to inward supply from unregistered person, shall, before commencement of movement, furnish information relating to the said goods in Part A of FORM GST EWB-01, electronically, on the common portal

E Way Bill and it’s Process

Who Causes Movement?

The movement of goods can be caused by the supplier if he is registered and he undertakes to transport the goods. In case the recipient undertakes to transport or arrange transport, the movement would be caused by him.

In case the goods are supplied by an unregistered supplier to a recipient who is registered, the movement shall be said to be caused by such recipient if the recipient is known at the time of

commencement of the movement of goods.

Generation of E Way Bill

Form GST EWB-01

Two Parts – A( Information)

and B( For the generation of E waybill; relating to transporter)

Who will generate E Way Bill?

- One who transports

- Supplier / Recipient- Part B

- If not above, registered person to fill part B and transporter to generate e waybill

Whether an e-way bill is to be issued, even when there is no supply?

Yes. Even if the movement of goods is caused due to reasons others than supply, the e-way bill is required to be issued.

• Reasons other than supply include movement of goods due to

• export/import,

• job-work,

• SKD or CKD,

• recipient not known,

• supply of liquid gas where quantity is not known,

• supply returns,

• exhibition or fairs,

• for own use,

• supply on approval basis and others etc.

Conditions

What if the value less than Rs. 50, 000/-

- E-way bill not compulsory

- Optional

Movement caused by unregistered person and Recipient is also unregistered or unknown

- E-way bill not compulsory

- Optional

Goods supplied by an unregistered Supplier

| Situation | Movement caused by |

Impact |

|---|---|---|

| Recipient is unknown |

Unregistered person |

E waybill not required; However, the supplier has an option to generate e-way bill |

| Recipient is known and is unregistered |

Unregistered person |

E waybill not required; However, the supplier has an option to generate e-way bill |

| Recipient is known and is registered |

Deemed to be caused by the Registered recipient |

Recipient to generate e-way bill |

What if Change……………..

Change of conveyance? In the course of transit?

- Update the transport details on the common portal Multiple Consignments in one conveyance? Individual consignments less than 50000/-, but total more than 50000/

- Generate consolidated e-way bill prior to movement; Transporter to issue consolidated E wayBill.

E Way Bill and it’s Process

What is the concept of acceptance of eway bill by the recipient?

• The details of e-way bill generated shall be made available to the recipient, if registered, on the common portal, who shall communicate his acceptance or rejection of the consignment covered by the e-way bill.

E Way Bill and it’s Process

Deemed Acceptance:

• In case, the recipient does not communicate his acceptance or rejection within seventy-two hours of the details being made available to him on the common portal, it shall be deemed that he has accepted the said details.

What if E way Bill and EBN generated, but goods not transported?

- Cancel E Way Bill within 24 hours of its generation

If E Waybill verified in transit,

- it cannot be canceled

Validity of E way Bill

| S/No1 | Distance | Validity Period |

|---|---|---|

| 1 | Less than 100 Km |

1 Day |

| 2 | For each 100 Km thereafter |

1 day |

What is a day for the e-way bill? How to count hours/day in the e-way bill?

• This has been explained in Rule 138(10) of CGST Rules, 2017.

• The “relevant date” shall mean the date on which the e-way bill has been generated and

• the period of validity shall be counted from the time at which the e-way bill has been generated and each day shall be counted as twenty-four hours.

May the validity period of the e-way bill be extended?

• In general No. However, Commissioner may extend the validity period only by way of issuance of a notification for certain categories of goods which shall be specified later.

• Also, if under circumstances of an exceptional nature, the goods cannot be transported within the validity period of the e-way bill, the transporter may generate another e-way bill after updating the details in Part B of FORM GST EWB-01.

• Goods can not move once the validity expires; Commissioner may extend the validity

E Way Bill and it’s Process

Acceptance by recipient

The details of e-way bill generated shall be made available to the recipient, if registered, on the common portal, who shall communicate his acceptance or rejection of the consignment covered by the e-way bill.

Non-communication of acceptance or otherwise

- within 72 hours shall be treated as deemed acceptance Invoice or bill of supply or delivery challan, as the case may be

- Or Invoice reference number generated on portal

A copy of the e-way bill or the e-way bill number, either physically or mapped to a Radio Frequency Identification Device (RFID) embedded on to the conveyance in such manner as may be notified by the Commissioner

- RFID mapping may be made compulsory for class of transporters ( Notification by Commissioner)

E Way Bill and it’s Process

Interception & Verification

RFID readers to be installed at places meant for verification Physical verification to be by authorized proper officers On receipt of specific information of evasion of tax, physical verification of a specific conveyance ….. after obtaining necessary approval of the Commissioner or an officer authorized by him in this behalf.

Inspection & Verification of goods

A summary verification report of every inspection of goods in transit

- within 24 hours (Part A of FORM GST EWB – 03 ) and Final report

- Within three days of the inspection(Part B of FORM GST EWB – 03 )Once physical verification is done,

- NO further verification in the state

- Unless specific information

What if the delay due to inspection?

Facility for uploading information regarding detention of vehicle Where a vehicle has been intercepted and detained for a period exceeding thirty minutes,

the transporter may upload the said information in FORM GST EWB- 04 on the common portal

Other Features of EWB

• E-Way Bill is invalid without vehicle number for transportation of more than 10 KMs

• Vehicle Number can be entered by generator of EWB or transporter

• E-way Bill with consignment should have the latest vehicle which is carrying the consignment

• No E-Way Bill is required for

- goods exempted for e-Way Bill

- transported in a non-motorised conveyance

- Consolidated E-Way Bill can be generated for the vehicle carrying multiple EWB consignment.

Stake Holders of Eway Bill

- Supplier

- Supplier Transporter

- Officer

- Recipient

Reasons other than Supply

- Exempted Supply;

- Export or Import;

- Job Work;

- Removal in SKD or CKD form;

- Line Sales;

- Sales Return

- Exhibition or fairs ;

- For own use (stock transfers etc.)

- Supply on Approval Basis.

;

E-Way Bill Format-EWB-01

PART A

• GSTIN of Recipient – GSTIN or URP

• Place of Delivery – PIN Code of Place

• Invoice/Challan No – Number

• Invoice/Challan Date – Date

• Value of Goods –

• HSN Code – At least 2 digit of HSN Code

• Reason for Transport – Supply/Exp/Imp/Job Work/…

• Transporter Doc. No – Document No provided by trans.

PART B

• Vehicle Number – Vehicle Number

E Way Bill and it’s Process

Disclaimer Above mention information only for educational purpose and general information purpose, not for the legal purpose, kindly read the latest respective notification.

Collected from varios sources i.e CBEC ,NACIN etc.

Permalink

Permalink