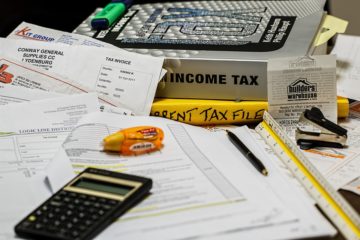

Challan Correction Mechanism

Reading Time: 3 minutesChallan Correction Mechanism Under OLTAS (On Line Tax Accounting System), the physical challans of all Direct Tax payments received from the deductors / taxpayers are digitized on daily basis by the collecting banks and the data transmitted to TIN (Tax Information Network) through link cell. At present, the banks are permitted to correct data relating

Read More