All About GST e-invoice system

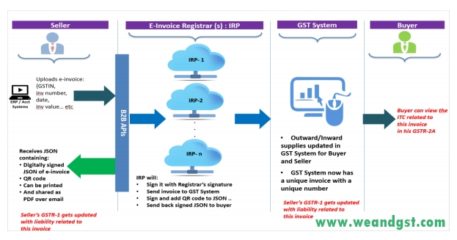

Reading Time: 4 minutesGST e-invoice system, As per Rule 48(4) of CGST Rules, notified class of registered persons have to prepare invoice by uploading specified particulars of invoice (in FORM GST INV-01) on Invoice Registration Portal (IRP) and obtain an Invoice Reference Number (IRN). After following above ‘e-invoicing’ process, the invoice copy containing inter alia, the IRN (with

Read More