Extension in dates of various GST Compliances for GST Taxpayers

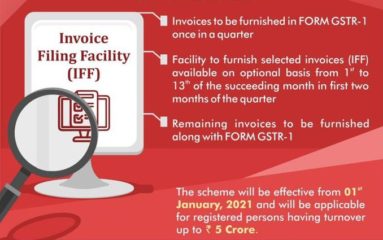

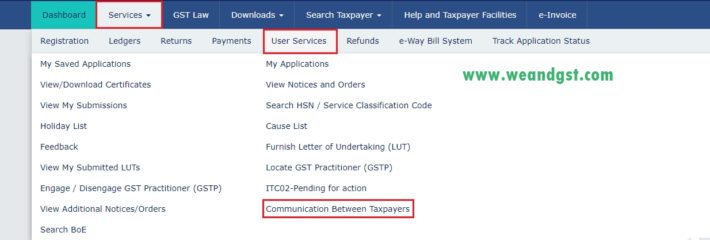

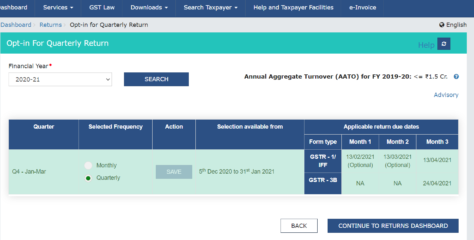

Reading Time: < 1 minuteExtension of GST Due dates, The CBIC has extended the dates of various compliances by Taxpayers under GST, vide Central Tax Notification Nos. 10/2021, 11/2021, 12/20211, 13/2021, 14/2021, all dated 1st May, 2021. The details are summarized below: D. Filing of Form GSTR-1/IFF by Normal Taxpayers: Sl.No. Return Type(Form) To be filed by Tax period Due Date Due Date

Read More