Quarterly Return Filing and Monthly Payment of Taxes (QRMP) Scheme under GST

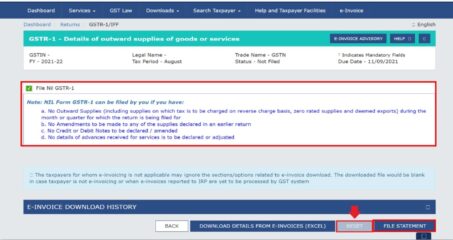

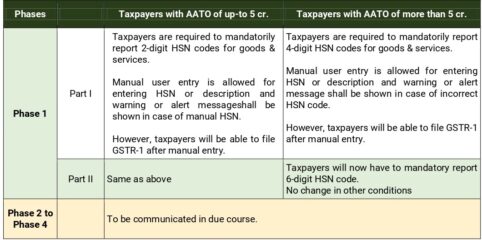

Reading Time: 6 minutesQRMP Scheme under GST QRMP Scheme under GST, registered persons having Aggregate Annual Turnover up to 5Cr may be allowed to furnish return on quarterly basis along with monthly payment of tax, with effect from 01.01.2021. This scheme of quarterly return filing along with monthly payment of taxes is referred to as “QRMP Scheme”. Eligibility

Read More