GSTR2 :what should a recipient do in his GST return?

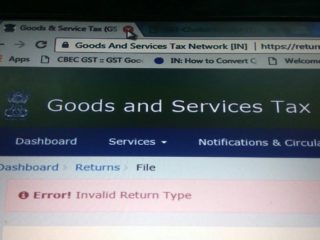

Reading Time: 2 minutes GSTR2 : what should a recipient do on his GST return? A receiver taxpayer can do the following in his GSTR2. Analyse the supplier-wise summary of gstr2 all invoices uploaded by the suppliers Against each invoice of the supplier ,receiver taxpayer can tax can take one of four possible actions – Accept,Modify ,Reject and

Read More