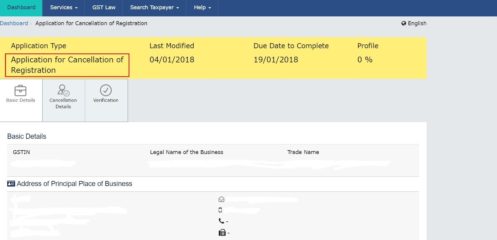

Cancellation of GST Registration

Reading Time: 3 minutes Cancellation of GST Registration Cancellation of GST Registration is now available on GST portal for the New taxpayers registered after 1st July 2017 The facility is available

Read More