Time of Supply in GST

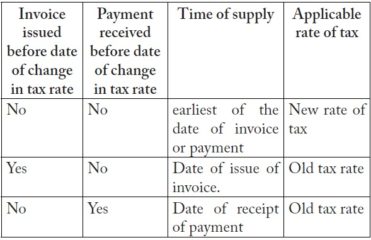

Reading Time: 7 minutesTime of Supply in GST Time of Supply: In order to calculate and discharge tax liability it is important to know the date when the tax liability arises i.e. the date on which the charging event has occurred. In GST law, it is known as Time of Supply. GST law has provided separate provisions to

Read More