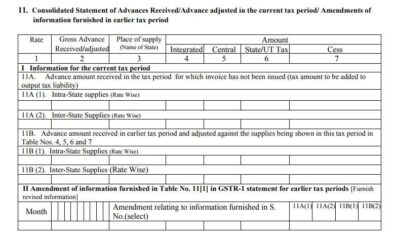

GST on Advance Received

Reading Time: 2 minutesGST on advance received, the time of supply determines when the taxpayer is required to discharge tax on particular supply. Time of supply provisions are governed by Section 12 to 14 of the CGST Act, 2017. As per the said provisions, the time of supply is determined with reference to the time when the supplier

Read More