Recommendations of 31st GST Council Meet

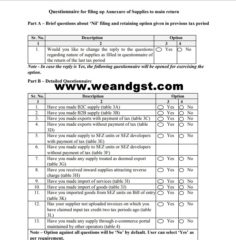

Reading Time: 4 minutesRecommendations of 31st GST Council Meet, The GST Council in its 31 meeting held today at New Delhi made the following policy recommendations: 1. There would be a single cash ledger for each tax head. The modalities for implementation would be finalized in consultation with GSTN and the Accounting authorities. 2. A scheme of single

Read More