Cancellation of GST Registration

Cancellation of GST Registration is now available on GST portal for the New taxpayers registered after 1st July 2017

The facility is available only for Migrated taxpayers from the earlier tax regime like Service tax, vat, excise, Entertainment tax etc but Voluntary registration can’t file cancellation within 1 year of registration

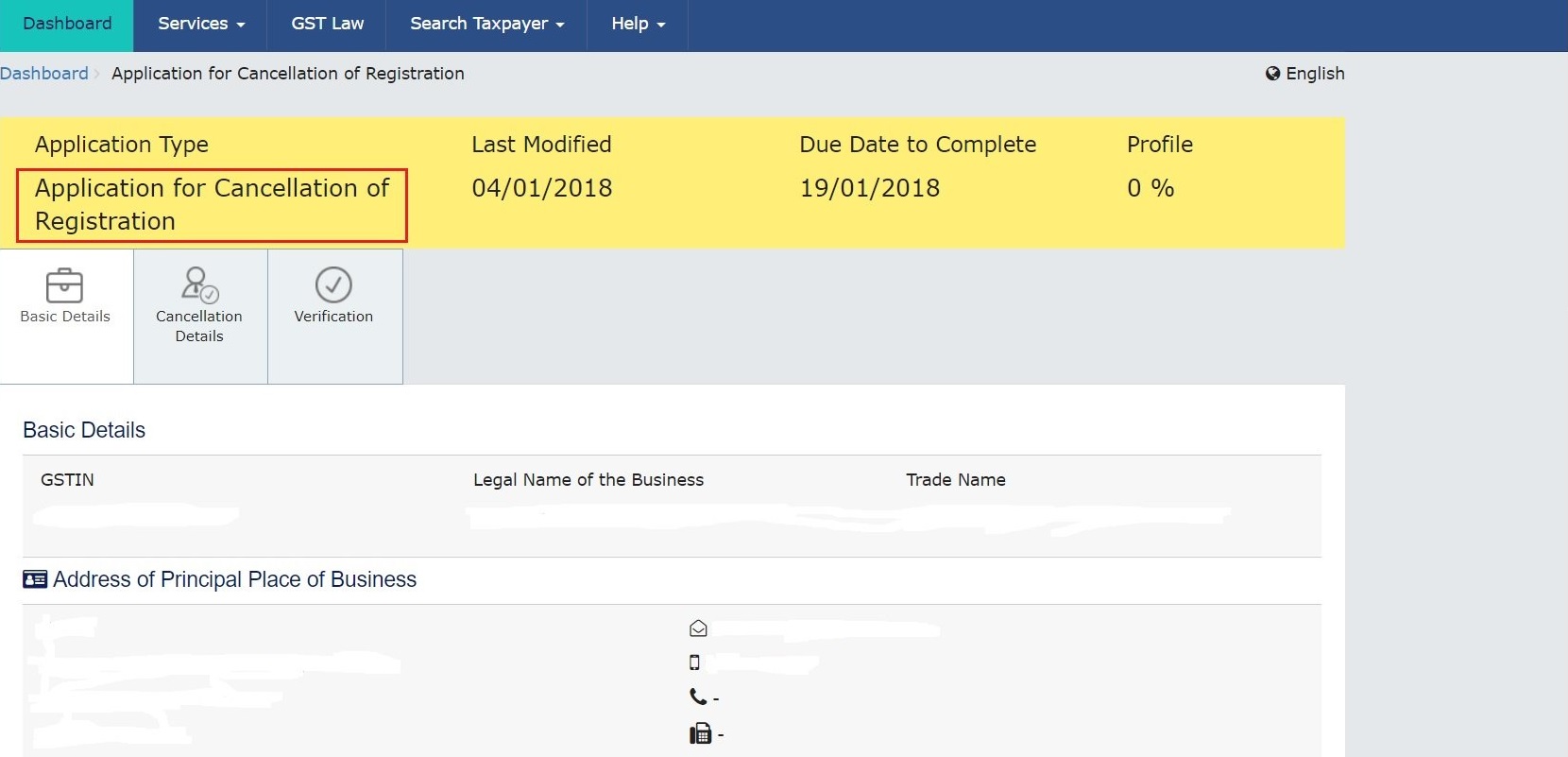

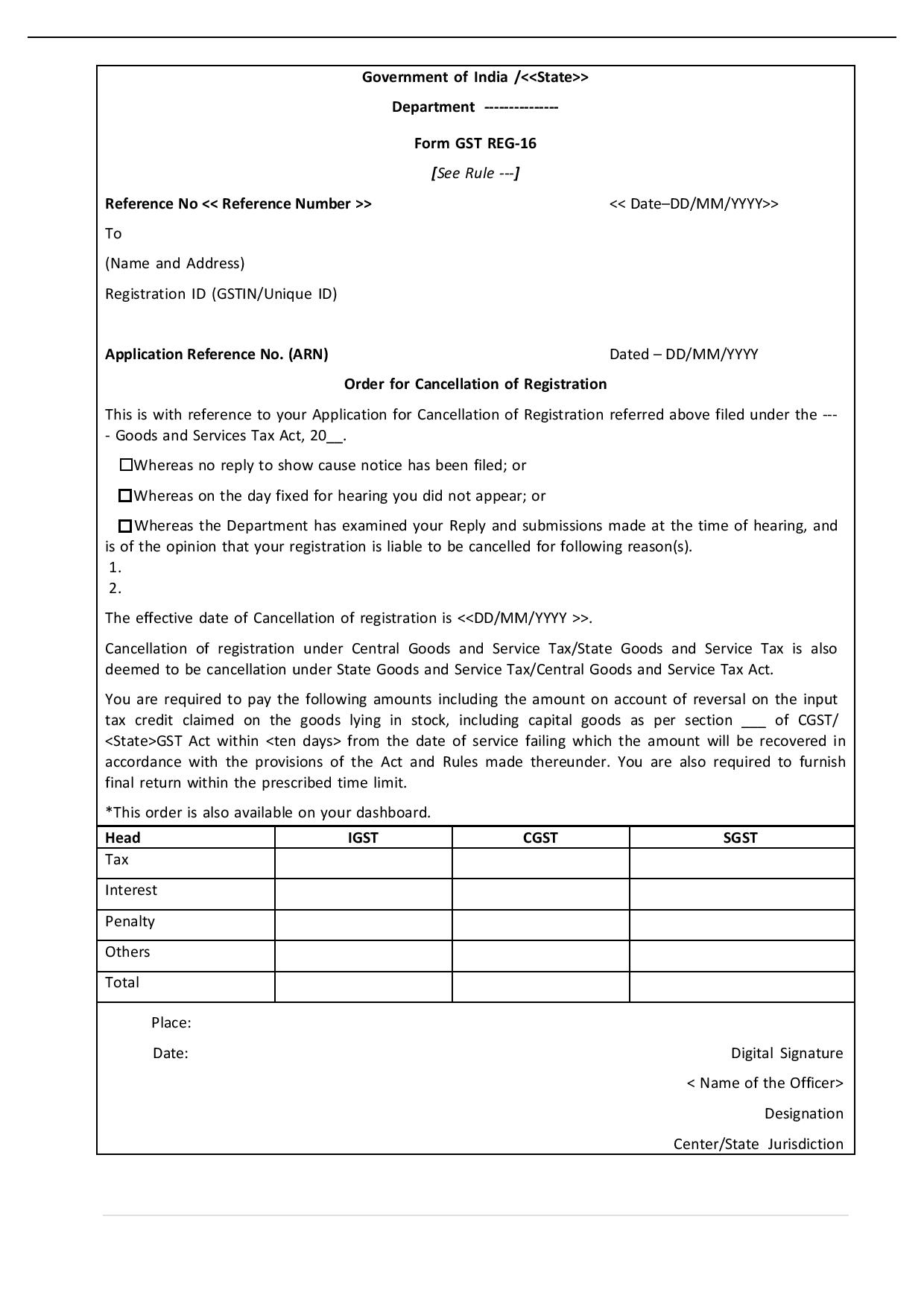

New Tax Payers (registered after July 1, 2017) can now apply online for cancellation of registration at GST portal through form GST REG-16

It the most demanding move from many taxpayers who are willing to close down their business or they has lower turnover and some them not even getting any benefit from GST registration.In many cases, they want to cancel the GST registration because GST does not apply to them or because they are shutting down your business or profession. Or there is some other valid reason due to which they want to cancel the GST registration.

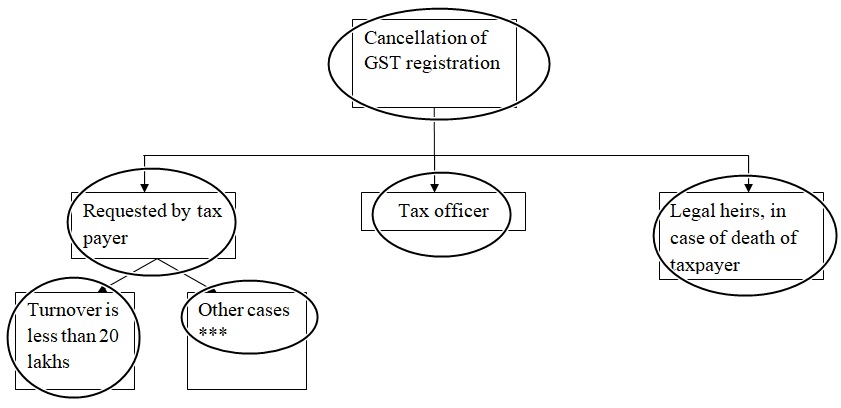

GST registration can be canceled by the below mention ways

GST Tax Payer issued Tax Invoices.

GST Tax Payer did not issue Tax Invoice.

GST Tax Payer issued Tax Invoice.

even If the Tax Payer has issued any Tax Invoice under GST regime still he can cancel his provisional GST Registration.

possible reasons for the cancellation of GST Registration,

- Discontinued the business.

- Amalgamation, Demerging, Disposed Off the Business, or Business transferred fully to another person.

- Change in constitution of the business.

- Death of the sole proprietor (in case of proprietorship business).

for the above-mentioned situations for the cancellation of the provisional GST Registration, the taxpayer needs to file an application in Form GST REG-16, provided in the GST Common Portal.

right now the cancellation facility for the provisional GST Registration for Tax Payers is available for only those who have migrated from earlier tax regime, taxpayers who have taken voluntarily registration has to wait until the financial year get complete.

GST Tax Payer did not issue Tax Invoice

Tax Payer who Had submitted the Enrolment Application in the GST Common Portal for migrating to GST from VAT, Service Tax, Excise, Entertainment Tax etc but not issued any Tax Invoice in GST may cancel their Registration by via his GST Account in GST Common Portal. And where he will find two option.

- Cancellation without successful migration

- Cancellation after successful migration.

Cancellation without successful migration

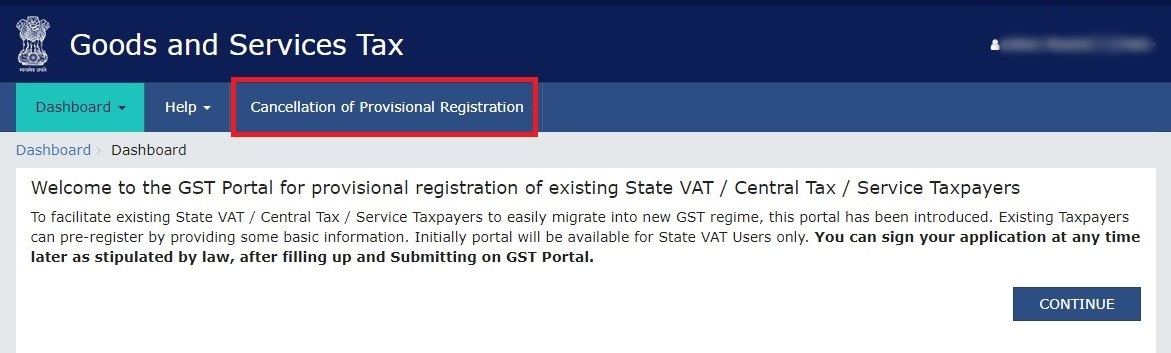

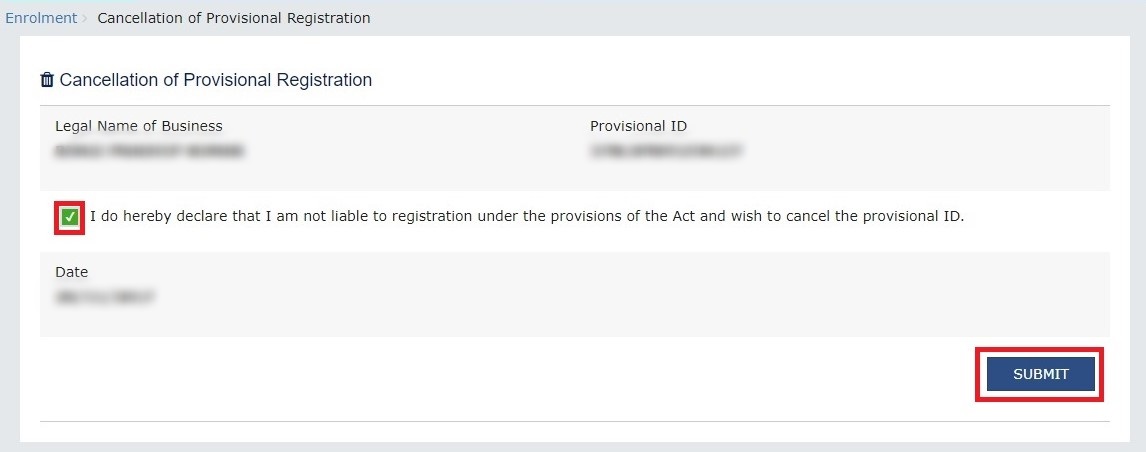

If he has submitted the enrolment application for migration which is not yet successfully migrated, then you can cancel the application by following the below steps.

- After you have logged in to the GST Portal

- Click on Cancellation of Provisional Registration.

After submitting the cancellation request, you will get an acknowledgment mail from the GST Portal regarding the cancellation keep the acknowledge number for future reference.

Cancellation after successful migration

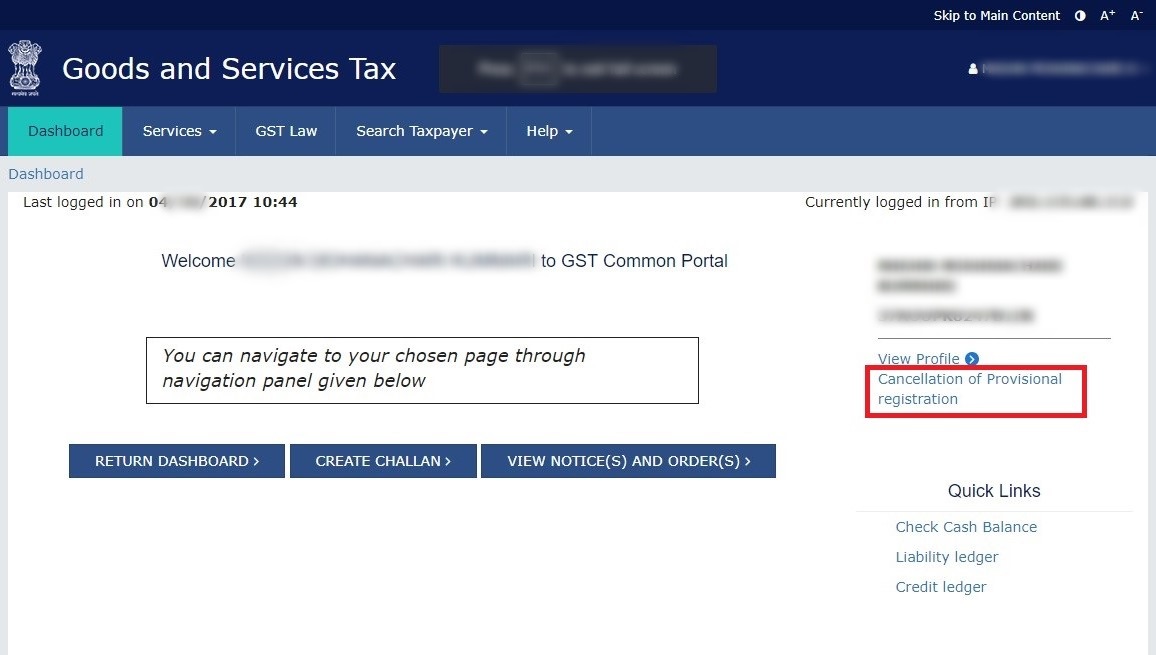

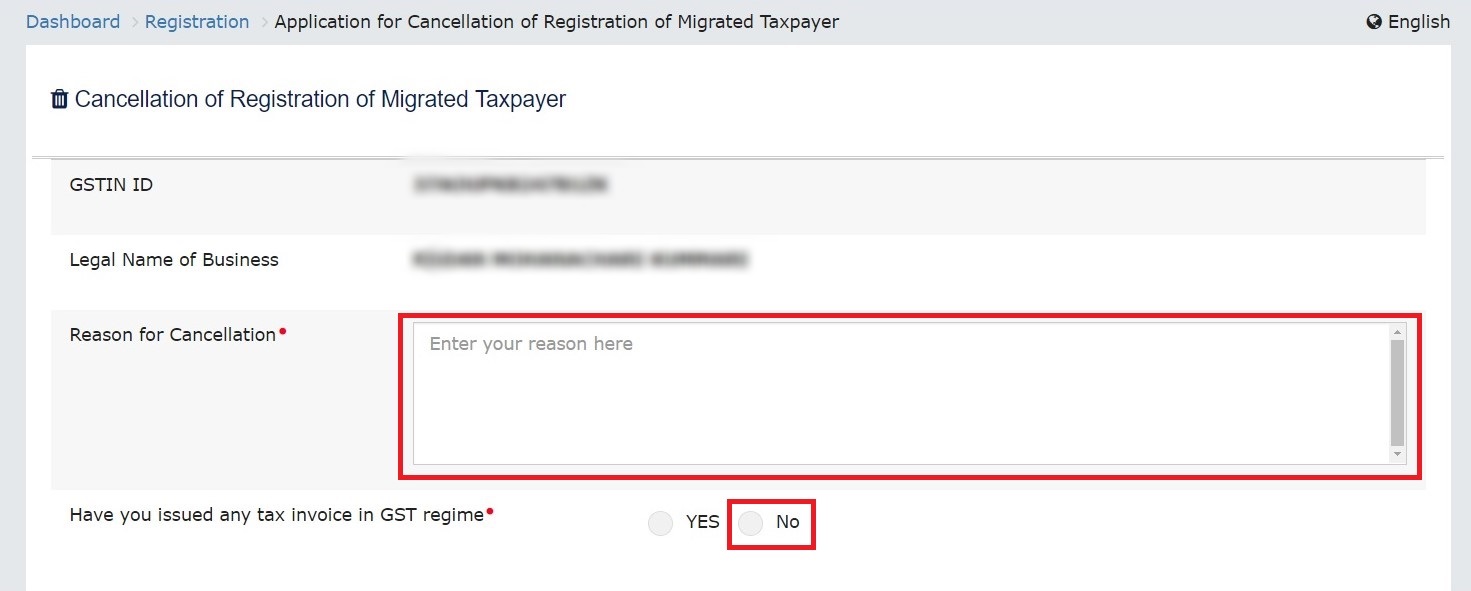

GST enrolment application is migrated successfully, you may follow the below steps.

- After you have logged in to the GST Portal

- Click hyperlink Cancellation of Provisional registration.

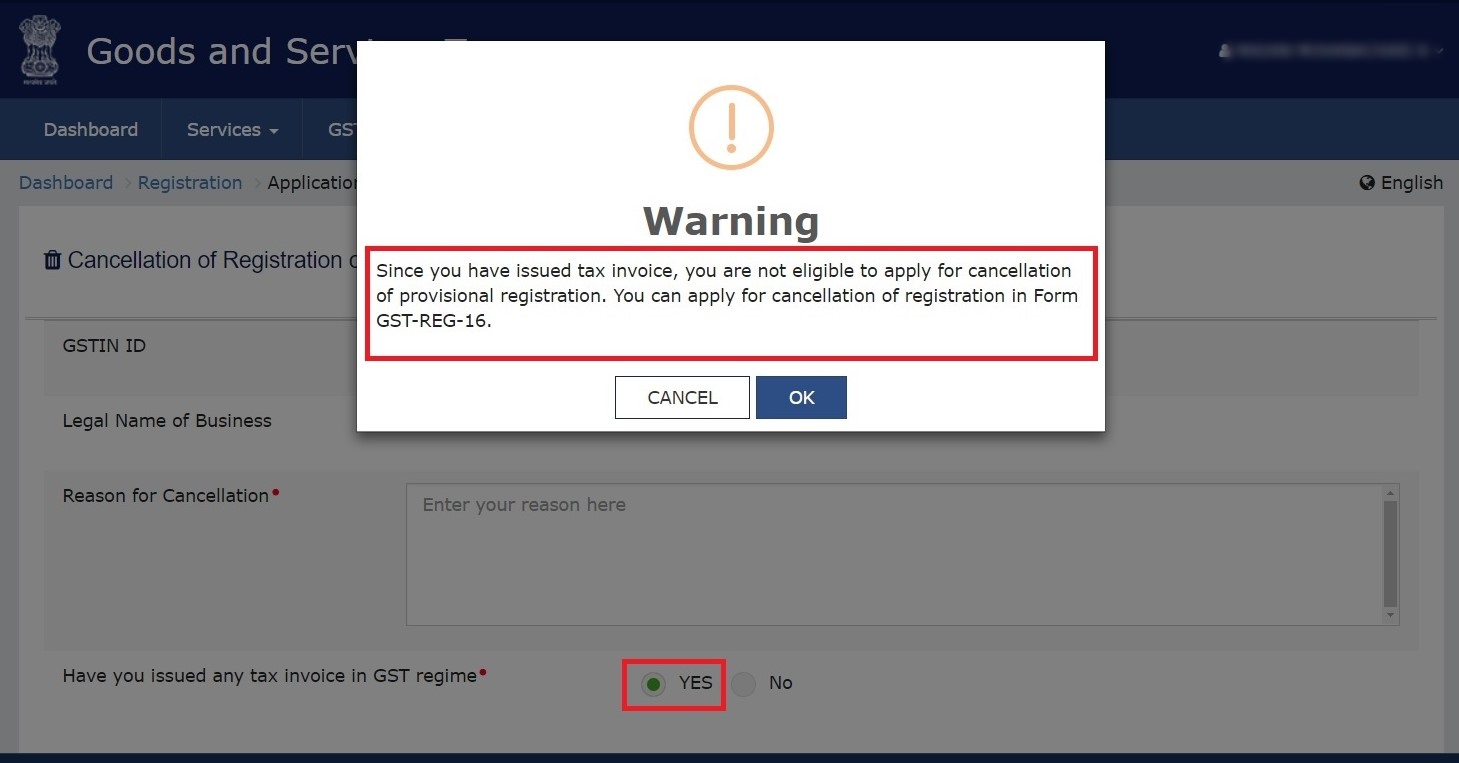

- Provide the reason for the cancellation of the provisional GST Registration in the box. And tick the No button for Have you issued any tax invoice in GST Regime option.

And finally, submit the application for the Cancellation. If you select Yes button you cannot submit the application and you will see the following error message.