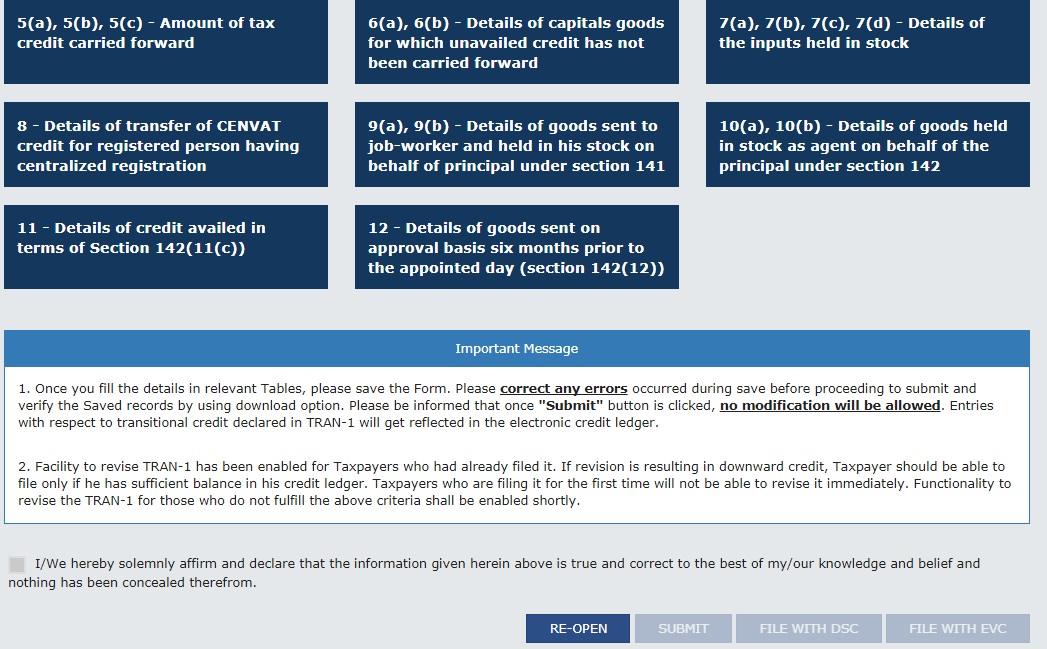

Many tax payers who made mistakes in GST TRAN-1 . now the can rectify the mistakes ,I line to fulfil the market requirement now Government of India has enabled the revision option on the common portal. If any taxpayer have a closing stock -whether registered or not before GST, is eligible to claim Input Tax Credit of tax paid under pre-GST regime. This claim of ITC is dependst to conditions specified in the GST Act. Filling the FORM TRAN 1 mandatory to the registered persons under GST regime , exept the taxpayers registered under GST as composition dealer

.authorities has clarified that the tax payers should have sufficient balance in his credit ledger if the revision results in download credit, Central Board of Excise and Customs (CBEC) issued a statement on official website of the said. “Facility to revise Form GST TRAN-1 has been enabled for Taxpayers who had already filed it. If revision is resulting in downward credit, Taxpayer should be able to file only if he has sufficient balance in his credit ledger. Taxpayers who are filing it for the first time will not be able to revise it immediately. Functionality to revise the TRAN-1 for those who do not fulfill the above criteria shall be enabled shortly,”

Permalink //

Hello ,

I saw your tweets and thought I will check your website. Have to say it looks very good!

I’m also interested in this topic and have recently started my journey as young entrepreneur.

I’m also looking for the ways on how to promote my website. I have tried AdSense and Facebok Ads, however it is getting very expensive. Was thinking about starting using analytics. Do you recommend it?

Can you recommend something what works best for you?

I also want to improve SEO of my website. Would appreciate, if you can have a quick look at my website and give me an advice what I should improve: http://janzac.com/

(Recently I have added a new page about FutureNet and the way how users can make money on this social networking portal.)

I have subscribed to your newsletter. 🙂

Hope to hear from you soon.

P.S.

Maybe I will add link to your website on my website and you will add link to my website on your website? It will improve SEO of our websites, right? What do you think?

Regards

Jan Zac