Compounding of Offences under GST or Compendium on prosecution in GST, to understand the Compounding of Offences under GST read section 138 of the Central Goods and Service Tax Act, 2017 which deals with the provisions of compounding of offences under GST Act, along with rule 162 of the Central Goods and Service Tax Rules, 2017 which deals with the procedure to be followed for compounding of offences.

under the GST Act ,the word compounding meaning has not been defined, However, taking the general meaning, Compounding means payment of monetary compensation / fine, to avoid suffering prosecution for an offence committed, which warrants such prosecution. so basically , Compounding is simply a compromise between the offender and the department to avoid proceedings .In compounding process the accused taxpayer is not required to appear personally and can be discharged on payment of compounding fee which cannot be more than the maximum fine leviable under the relevant provisions. GST Act also allows for compounding of offences.

Section 138 of the CGST Act, 2017

Any offence under this Act may, either before or after the institution of prosecution, be compounded by the Commissioner on payment, by the person accused of the offence, to the Central Government or the State Government, as the case be, of such compounding amount in such manner as may be prescribed:

Provided that nothing contained in this section shall apply to-

(a) a person who has been allowed to compound once in respect of any of the offences specified in clauses (a) to (f), (h), (i) and (l) of sub-section (1) of section 132;

(b) a person who has been accused of committing an offence under clause (b) of sub-section (1) of section 132;

(c) a person who has been convicted for an offence under this Act by a court;

(d) any other class of persons or offences as may be prescribed:

Provided further that any compounding allowed under the provisions of this section shall not affect the proceedings, if any, instituted under any other law:

Provided also that compounding shall be allowed only after making payment of tax, interest and penalty involved in such offences.

The amount for compounding of offences under this section shall be such as may be prescribed, subject to the minimum amount not being less than twenty-five per cent of the tax involved and the maximum amount not being more than one hundred per cent of the tax involved per.

On payment of such compounding amount as may be determined by the Commissioner, no further proceedings shall be initiated under this Act against the accused person in respect of the same offence and any criminal proceedings, if already initiated in respect of the said offence, shall stand abated.

The amount payable for compounding of offences shall be 50% of the tax involved subject to a minimum Rs. 10,000. Maximum amount for compounding is 150% of the tax OR Rs. 30,000 -Whichever is higher.

Rule 162. Procedure for compounding of offences. –

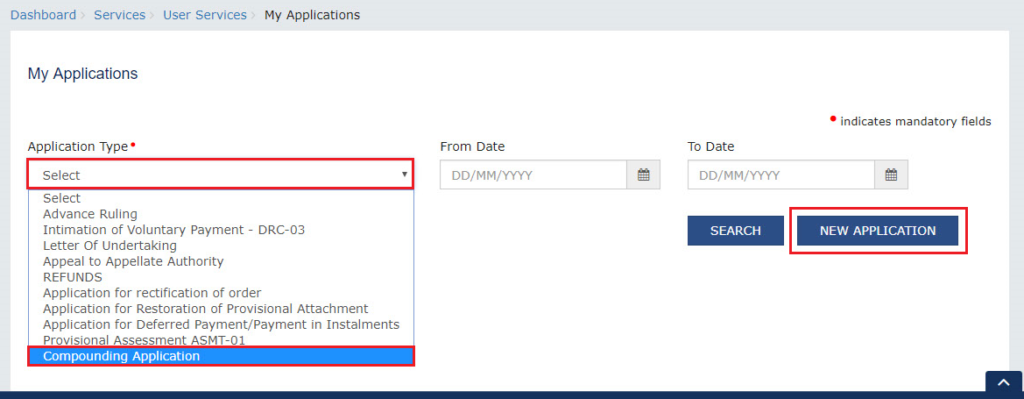

(1) An applicant may, either before or after the institution of prosecution, make an application under sub-section (1) of section 138 in FORM GST CPD-01 to the Commissioner for compounding of an offence.

(2) On receipt of the application, the Commissioner shall call for a report from the concerned officer with reference to the particulars furnished in the application, or any other information, which may be considered relevant for the examination of such application.

(3) The Commissioner, after taking into account the contents of the said application, may, by order in FORM GST CPD-02, on being satisfied that the applicant has made full and true disclosure of facts relating to the case, allow the application indicating the compounding amount and grant him immunity from prosecution or reject such application within ninety days of the receipt of the application.

(3A) The Commissioner shall determine the compounding amount under sub-rule (3) as per the Table below:-

| S. No. | Offence | Compounding amount if offence is punishable under clause (i) of sub-section (1) of section 132 | Compounding amount if offence is punishable under clause (ii) of sub-section (1) of section 132 |

| (1) | (2) | (3) | (4) |

| 1 | Offence specified in clause (a) of sub-section (1) of section 132 of the Act | Up to seventy-five per cent of the amount of tax evaded or the amount of input tax credit wrongly availed or utilised or the amount of refund wrongly taken, subject to minimum of fifty per cent of such amount of tax evaded or the amount of input tax credit wrongly availed or utilised or the amount of refund wrongly taken. | Up to sixty per cent of the amount of tax evaded or the amount of input tax credit wrongly availed or utilised or the amount of refund wrongly taken, subject to minimum of forty per cent of such amount of tax evaded or the amount of input tax credit wrongly availed or utilised or the amount of refund wrongly taken. |

| 2 | Offence specified in clause (c) of sub-section (1) of section 132 of the Act | ||

| 3 | Offence specified in clause (d) of sub-section (1) of section 132 of the Act | ||

| 4 | Offence specified in clause (e) of sub-section (1) of section 132 of the Act | ||

| 5 | Offence specified in clause (f) of sub-section (1) of section 132 of the Act | Amount equivalent to twenty five per cent of tax evaded. | Amount equivalent to twenty five per cent of tax evaded. |

| 6 | Offence specified in clause (h) of sub-section (1) of section 132 of the Act | ||

| 7 | Offence specified in clause (i) of sub-section (1) of section 132 of the Act | ||

| 8 | Attempt to commit the offences or abets the commission of offences mentioned in clause (a), (c) to (f) and clauses (h) and (i) of subsection (1) of section 132 of the Act | Amount equivalent to twenty five per cent of such amount of tax evaded or the amount of input tax credit wrongly availed or utilised or the amount of refund wrongly taken. | Amount equivalent to twenty five per cent of such amount of tax evaded or the amount of input tax credit wrongly availed or utilised or the amount of refund wrongly taken. |

Provided that where the offence committed by the person falls under more than one category specified in the Table above, the compounding amount, in such case, shall be the amount determined for the offence for which higher compounding amount has been prescribed.

(4)The application shall not be decided under sub-rule (3) without affording an opportunity of being heard to the applicant and recording the grounds of such rejection.

(5) The application shall not be allowed unless the tax, interest and penalty liable to be paid have been paid in the case for which the application has been made.

(6) The applicant shall, within a period of thirty days from the date of the receipt of the order under sub-rule (3), pay the compounding amount as ordered by the Commissioner and shall furnish the proof of such payment to him.

(7) In case the applicant fails to pay the compounding amount within the time specified in sub-rule (6), the order made under sub-rule (3) shall be vitiated and be void.

(8) Immunity granted to a person under sub-rule (3) may, at any time, be withdrawn by the Commissioner, if he is satisfied that such person had, in the course of the compounding proceedings, concealed any material particulars or had given false evidence. Thereupon such person may be tried for the offence with respect to which immunity was granted or for any other offence that appears to have been committed by him in connection with the compounding

proceedings and the provisions the Act shall apply as if No such immunity had been granted.