Section 139AA of the Income Tax Act provides that every individual person who has been allotted a Permanent Account Number (PAN) as on the 1st day of July, 2017, and who is eligible to obtain an Aadhaar number, shall intimate Aadhaar number in the prescribed form and manner. In other words, such persons have to mandatorily link their Aadhaar and PAN before the prescribed date (31.03.2022 without fee payment and 31.03.2023 with prescribed fee payment). For more details refer to CBDT Circular No.7/2022 dated 30.03.2022.

Prerequisites for availing of this service:

- Aadhaar PAN linkage is not done before (31.03.2022 without fee payment and 31.03.2023 with prescribed fee payment)

- Valid PAN

- Aadhaar number

- Valid mobile number

For whom is Aadhaar-PAN linkage not compulsory?

Aadhaar-PAN linkage requirement does not apply to any individual who is:

- Residing in the States of Assam, Jammu and Kashmir, and Meghalaya;

- a non-resident as per the Income-tax Act, 1961;

- of the age of eighty years or more at any time during the previous year; or

- not a citizen of India.

Here’s what happens if you don’t link your Aadhaar-PAN by 31st March 2023:

- Your PAN Card will become inoperative until linked with Aadhaar

- TDS/ TCS deduction will attract a higher rate applicable to PAN not present.

- You will NOT be able to do many banking services such as:

- Book a Fixed Deposit above Rs. 50,000

- Deposit cash above Rs. 50,000.

- Get a new Debit/Credit Card

- Invest or redeem your Mutual Funds.

- Purchase any foreign currency beyond Rs. 50,000.

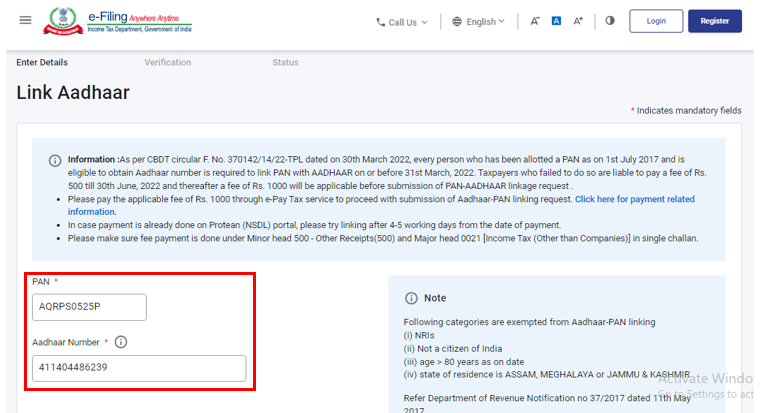

Follow these steps to link your Aadhaar with your PAN:

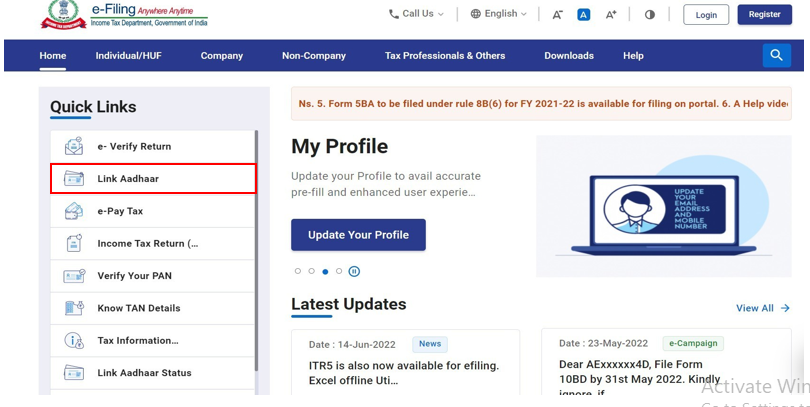

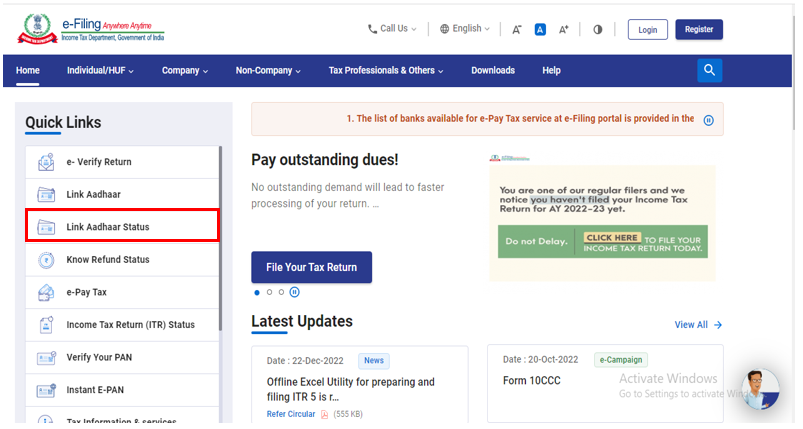

Step 1: Visit Income Tax Portal: https://incometax.gov.in/iec/foportal/

Step 2: Click on “Link Aadhaar” in the Quick Links section on the Left side Panel

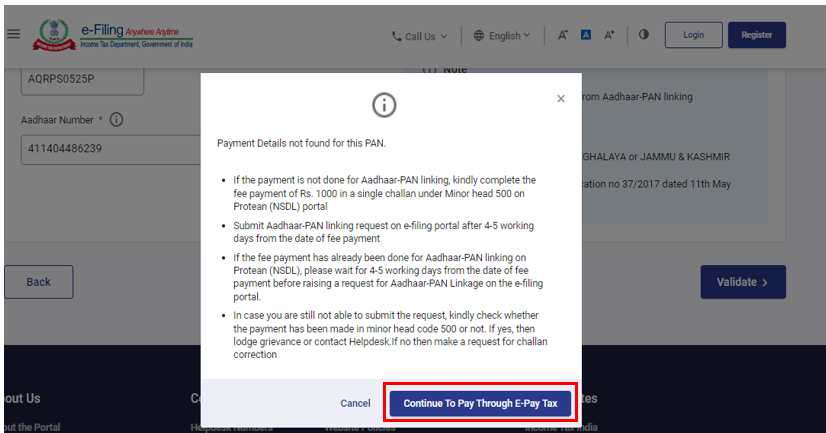

Step 3: Click on “Continue to Pay Through e-Pay Tax”, in case you have not paid the requisite fees

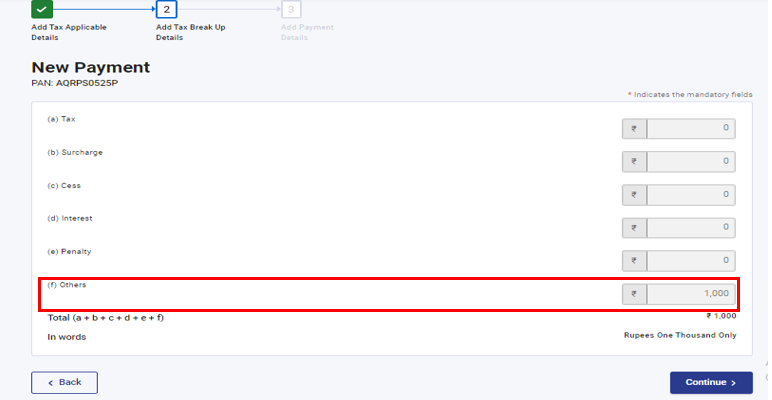

Step 4: Payment of Fees Mandatory to pay fees of Rs. 1000 to complete the PAN-Aadhar linking process after 31st March 2022 and before 31st March 2023.

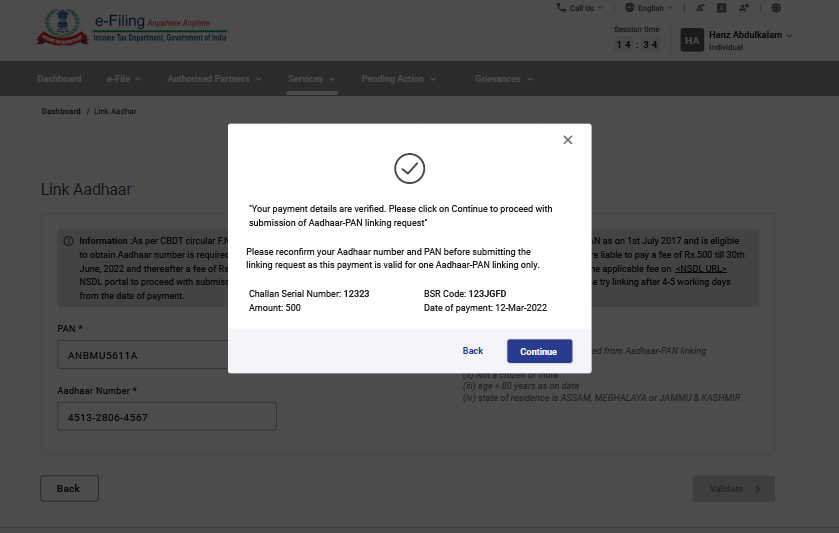

Step 5: Submit the Aadhaar PAN Linking Request on the Portal after making the Payment of the requisite fees

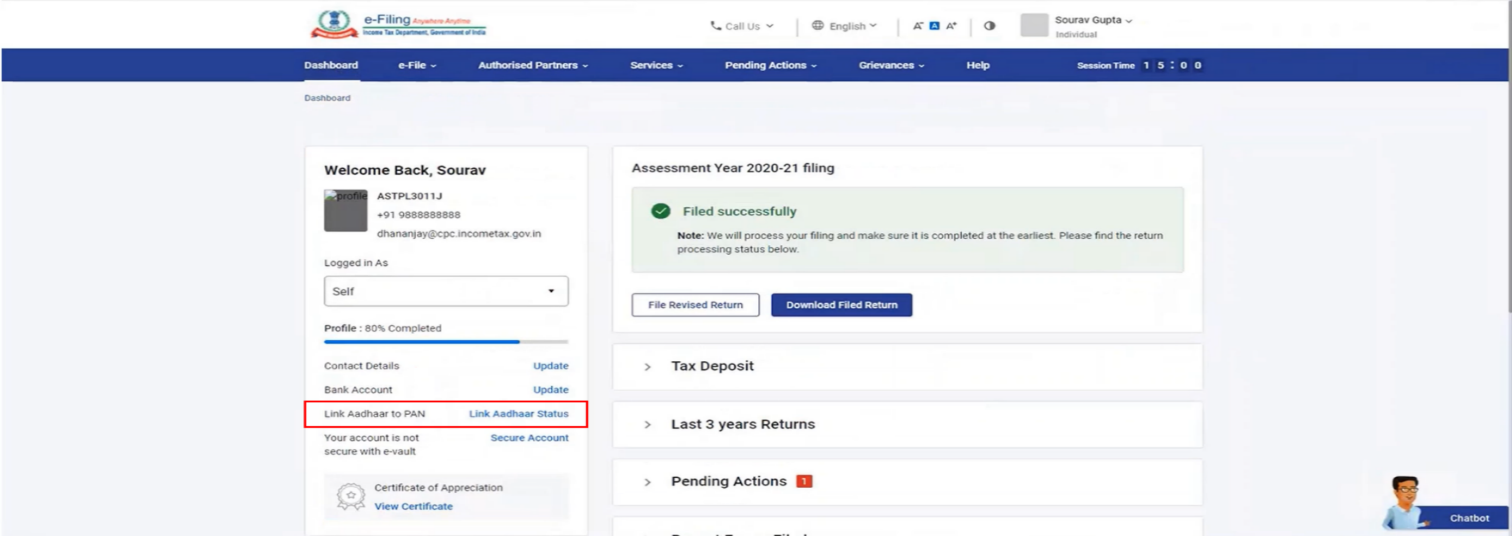

Step 6: You can check your status of PAN Aadhaar linking on the Income Tax Portal both through Pre login and Post login mode

Pre Login Mode :-

View Link Aadhaar Status (Post-Login)

Other methods of linking PAN with Aadhaar:

- Individuals can also visit the following websites for the linking process- https://www.utiitsl.com/ and https://www.egov-nsdl.co.in/

- Through the SMS service: Type the following message UIDPAN<12 digit Aadhaar><10 digit PAN>. The message can be sent to 567678 or 56161.

- Visiting nearby PAN service centres: The linking process can also be done manually by visiting the nearby PAN service center.

Unable to link Pan Aadhar?

- Individuals may be unable to link their PAN to their Aadhaar in some cases. The most common reason for rejection is a mismatch between the information in your PAN and Aadhaar. Ideally, your demographic information (name, gender, and date of birth) should match in both the documents.

- If there is a minor mismatch between your Aadhaar Name and the actual data in Aadhaar, a One Time Password (Aadhaar OTP) will be sent to the mobile phone registered with Aadhaar. Ensure that PAN and Aadhaar have the same date of birth and gender.

- In a rare case where Aadhaar name is completely different from name in PAN, then the linking will fail and you will be prompted to change the name in either Aadhaar or in PAN database.

- However, once the corrections have been made, you will able to link the PAN and Aadhaar.

Note: PAN card will become inoperative from 01st April 2023 if PAN holders do not link it with their Aadhaar card.

Permalink

Permalink