Revocation of Cancellation of GST Registration, The registration granted under GST can be cancelled for specified reasons. The cancellation can either be initiated by the department at its own motion (Suo Moto Cancellation) or the registered person can apply for cancellation of their registration. In case of the death of the registered person, in case of proprietorship concern, the legal heirs can apply for cancellation. In case the registration has been cancelled by the department there is a provision for revocation of the cancellation of registration at the request of the taxpayer. On cancellation of the registration, the person has to file a return which is called the final return. The final return has to be filed within three months of cancellation of GST registration.

Revocation of Cancellation of registration:

Time Limit for Revocation

When the registration has been cancelled by the proper officer, on its own motion and not on the basis of an application by the registered person, then the registered person, whose registration has been cancelled, can submit an application for revocation of cancellation of registration, in FORM GST REG-21, to the Proper Officer, within a period of thirty days from the date of the service of the order of cancellation of registration at the common portal or offline mode,

either directly or through a Facilitation Centre notified by the Commissioner.

The period of thirty days can be extended by-

• by the Additional Commissioner or the Jt Commissioner, as the case may be, for a period not exceeding thirty days;

• by the Commissioner, for a further period not exceeding thirty days, beyond the period specified in above.

(b) However, if the registration has been cancelled for failure to furnish returns, an application for revocation shall be filed, only after such returns are furnished and any amount due as tax, in terms of such returns, has been paid along with any amount payable towards interest, penalty and late fee in respect of the said returns.

Processing of Application

On examination of the application if the Proper Officer is satisfied, for reasons to be recorded in writing, that there are sufficient grounds for revocation of cancellation of registration, then he shall revoke the cancellation of registration by an order in FORM GST REG-22 within a period of thirty days from the date of the receipt of the application and communicate the same to the applicant.

Rejection of Application

However, if on examination of the application for revocation, the Proper Officer is not satisfied then he will issue a notice in FORM GST REG–23 requiring the applicant to show cause as to why the application submitted for revocation should not be rejected and the applicant has to furnish the reply within a period of seven working days from the date of the service of the notice in FORM GST REG-24.

(e) Upon receipt of the information or clarification in FORM GST REG24, the Proper Officer shall dispose of the application within a period of thirty days from the date of the receipt of such information or clarification from the applicant. In case the information or clarification provided is satisfactory, the Proper Officer shall dispose of the application as per para (c) above. In case it is not satisfactory, the applicant will be mandatorily given an opportunity

of being heard, after which the Proper Officer after recording the reasons in writing may by an order in FORM GST REG- 05, reject the application for revocation of cancellation of registration and communicate the same to the applicant.

(f) The revocation of cancellation of registration under the SGST Act or the UTGST Act, as the case may be, shall be deemed to be a revocation of cancellation of registration under CGST Act & vice versa.

(g) All returns due for the period from the date of the order of cancellation of registration till the date of the order of revocation of cancellation of registration shall be furnished by the said person within a period of thirty days from the date of order of revocation of cancellation of registration.

(h) Where the registration has been cancelled with retrospective effect, the registered person shall furnish all returns relating to the period from the effective date of cancellation of registration till the date of order of revocation of cancellation of registration within a period of thirty days from the date of order of revocation of cancellation of registration.

(i) Where the registration has been suspended under Rule 21A (2A) for contravention of the provisions contained

in clause (b) or clause (c) of sub-Section (2) of Section 29 and the registration has not already been cancelled by

the proper officer, the suspension of registration shall be deemed to be revoked upon the furnishing of all the pending

returns.

(j) The cancellation of registration shall not affect the liability of the person to pay tax and other dues or to discharge any obligations under GST Act or Rules made there under for any period prior to the date of cancellation whether or not such tax and other dues are determined before or after the date of cancellation

Revocation of Cancellation of GST Registration

The following steps which a registered person needs to be followed, who wants to apply for revocation online through the GST Common Portal:

- Access the GST Portal at www.gst.gov.in.

- In order to log in to the account, enter the username and appropriate password.

- Select services in the GST Dashboard, under services select registration and further under registration select application for revocation of cancelled registration option.

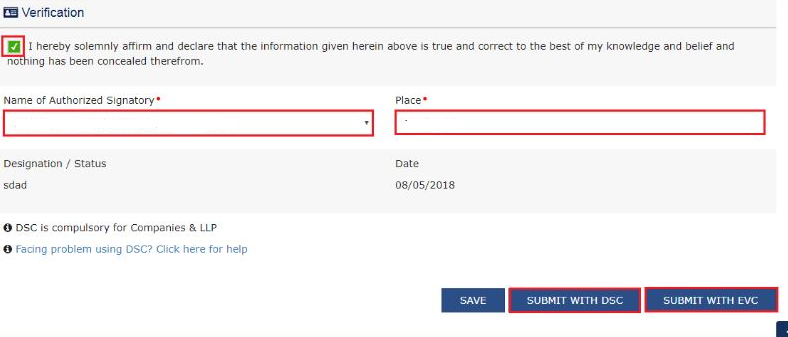

- Select the option of applying for revocation of cancelled registration. In the select box, enter the reason for revocation of GST registration cancellation. Further, you need to choose the appropriate file to be attached for any supporting documents and you need to select the verification checkbox and select the name of the authorized signatory and fill up the place filed box.

- The final step would be to select SUBMIT WITH DSC OR SUBMIT WITH EVC box.

Permalink