Many of Professionals are facing the “Error Invalid Return Type” ” in GSTR3B Return for as shown in the below image

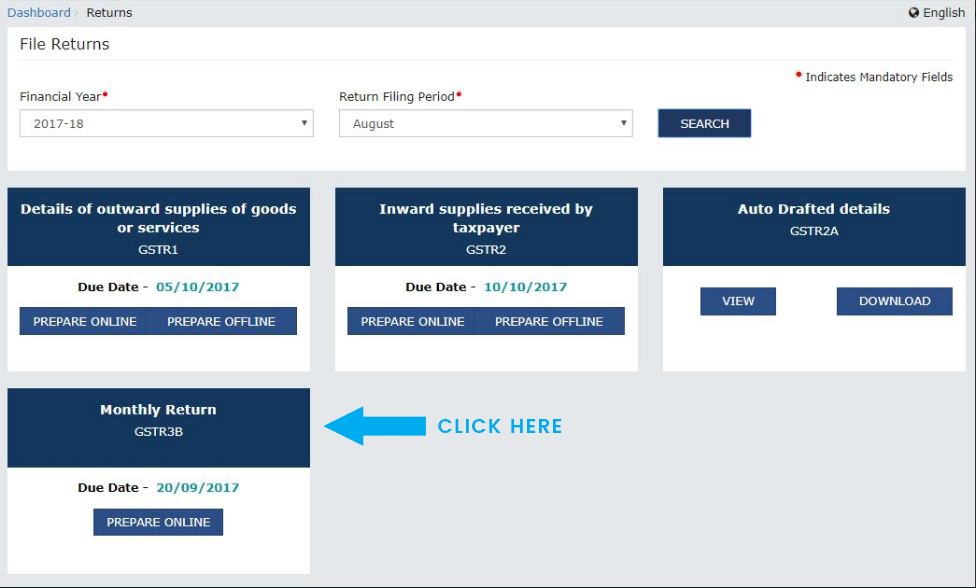

Solution

It’s a minor problem and it’s can be fixed in few seconds. just follow the below mention step.

To avoid getting this error, please click on the tile ‘Monthly Return GSTR 3B’ to file GSTR 3B

Important Points

A. Registered persons planning not to avail transitional credit for discharging the tax liability

for the month of July 2017 or new registrants who do not have any transitional credit to avail need to follow the steps as detailed below:

I. Calculate the tax payable as per the following formula:

Tax payable = (Output tax liability + Tax payable under reverse charge) – input tax credit availed for the month

II. Tax payable as per (i) above to be deposited in cash on or before 20th date of following month which will get credited to electronic cash ledger;

III. File the return in FORM GSTR-3B on or before 20th date of following month after discharging the tax liability by debiting the electronic credit or cash ledger.

B. Registered persons planning to avail transitional credit for discharging the tax liability for the month of the need to follow the steps as detailed below:

I. Calculate the tax payable as per the following formula:

Tax payable = (Output tax liability + Tax payable under reverse charge) – (transitional credit + input tax credit availed for the month ;

II. Tax payable as per (i) above to be deposited in cash on or before 20th date of following month which will get credited to electronic cash ledger;

III.File FORM GST TRAN-1 (which will be available on the common portal from 21.08.2017) before filing the return in FORM GSTR-3B;

IV.In case the tax payable as per the return in FORM GSTR-3B is greater than the cash amount deposited as per (ii) above, deposit the balance in cash along with interest @18% calculated from 21.08.2017 till the date of such deposit. This amount will also get credited to electronic cash ledger;

V. File the return in FORM GSTR-3B on or before 28.08.2017 after discharging the tax liability by debiting the electronic credit or cash ledger.

for more solution please refer to www.cbec.gov.in