Form GSTR2B is an auto-generated Input Tax Credit statement, which will be generated for every recipient as per the data filled by the suppliers in their respective Forms GSTR-1, GSTR-5 and GSTR-6., It will clear that the input tax credit is available or not for every document filed by the supplier.

Taxpayers can now reconcile data generated in Form GSTR2B, with their own records and books of accounts. Using this reconciliation, they can now file their Form GSTR 3B and they can ensure that

-

- no credit is taken twice,

- credit is reversed as per law, &

- tax on reverse charge basis is paid.

Generated Form GSTR2B consists of:

-

-

- A summary of ITC available as on the date of its generation and is divided into credit that can be availed and credit that is to be reversed (Table 3)

- A summary of ITC not available and is divided into ITC not available and ITC reversal (Table 4)

-

It is a static statement, generated once on 12th of following month.

-

-

-

- It consists of all documents filed by suppliers/ISD in their Form GSTR-1, 5 & 6, between 00:00 hours on 12th day of preceding month to 23:59 hours, on 11th day of current month. Thus, statement generated on 12th of August will contain data from 00:00 hours of 12th July to 23:59 hours of 11th

- The details filed in GSTR-1 & 5 (by supplier) & GSTR-6 (by ISD) would reflect in the next open GSTR-2B of the recipient irrespective of supplier’s/ISD’s date of filing. For e.g, if a supplier files a document INV-1 dt. 15.07.2020 on 11th August, it will get reflected in GSTR-2B of July (generated on 12th August). If the document is filed on 12th August, 2020 the document will be reflected in GSTR-2B of August (generated on 12th September).

-

-

It also contains information on imports of goods from the ICEGATE system including data on imports from Special Economic Zones Units / Developers. (This will be made available in GSTR-2B from 12th September 2020 onward). Reverse charge credit on import of services is not part of this statement and need to be entered by taxpayers in Table 4(A) (2) of FORM GSTR-3B.

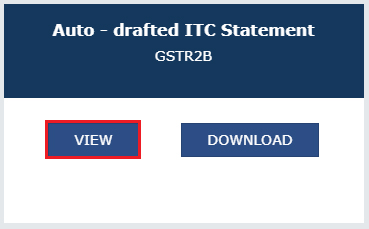

Steps to Download Form GSTR2B : Taxpayers can access their GSTR-2B through: Login to GST Portal > Returns Dashboard > Select Return period > GSTR2B.

- Important features: Taxpayers can

- View or download Summary Statement or Section wise details in excel or PDF format.

- Taxpayers can view supplier wise summary or document wise details.

- Email / SMS to taxpayer will be sent informing them about generation of GSTR2B.

Diffrence between Form GSTR-2A and Form GSR2B

| Particulars | Form GSTR-2A | Form GSTR2B |

| Dynamic vs Static statement | GSTR-2A is a dynamic statement, since the same is updated on timely basis, whenever the supplier uploads the documents | GSTR-2B is an static statement, since the same is generated on 12th of next month and not impacted due to later changes by supplier |

| Periodicity | Monthly Basis | Monthly Basis |

| Source of information | Form GSTR-1, 5, 6,7, 8 | Form GSTR-1, 5,6, ICEGATE system (Import cases) |

| ITC on Import of Goods | GST RCM on import of goods is not reflected in GSTR-2A | GST RCM on import of goods is reflected in GSTR-2B basis the data fetched from ICEGATE system |

Also Read : Recent Changes in GSTR3B filing