GST on advance received, the time of supply determines when the taxpayer is required to discharge tax on particular supply. Time of supply provisions are governed by Section 12 to 14 of the CGST Act, 2017. As per the said provisions, the time of supply is determined with reference to the time when the supplier receives payment with respect to the supply as well as a few other references like issue of invoice, receipt of goods etc.

As per the explanation 1 to Section 12 of the CGST Act, 2017 a “supply” shall be deemed to have been made to the extent it is covered by the invoice or, as the case may be, the payment.

as per the notification no. 66/2017 dated 15.11.2017, whereby all suppliers of goods who have not opted for composition scheme, have been exempted from the burden of paying GST on Advances received but the supplier of services are required to pay GST at the time of receipt of advances.

notification no. 66/2017 dated 15.11.2017

Compliances under GST:

As per Section 31 (3) (d) of the CGST Act, 2017, a registered person shall, on receipt of advance payment with respect to any supply of goods or services or both, issue a receipt voucher or any other document, containing such particulars as may be prescribed, evidencing receipt of such payment;

The receipt voucher shall contain the particulars as contained in Rule 50 of the CGST Rules, 2017.

What if the rate of tax or place of supply is not determinable at the time of receiving advance payment?

according to the proviso to Rule 50 provides that where at the time of receipt of advance, if the rate of tax is not determinable, the tax shall be paid at the rate of 18% and if the nature of supply is not determinable, the same shall be treated as inter-State supply and GST should be paid accordingly.

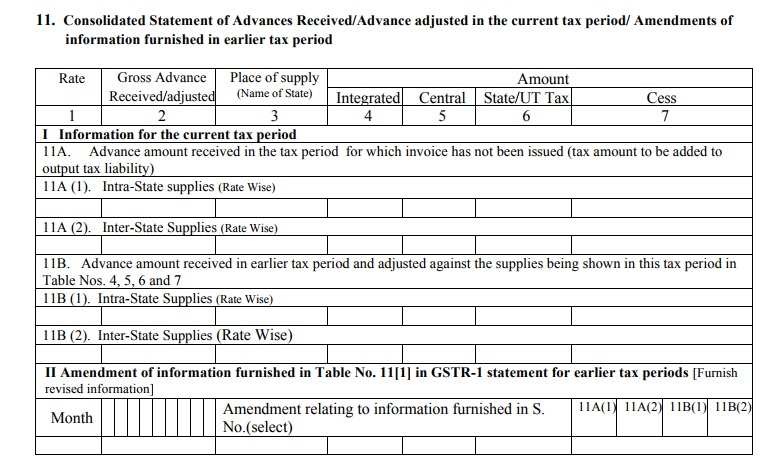

Table 11 of GSTR 1: Consolidated Statement of Advances Received/Advance adjusted in the current tax period/ Amendments of information furnished in earlier tax period: Rate wise and intra/interstate wise

Table 11A of FORM GSTR-1 captures information related to advances received, rate-wise, in the tax period and tax to be paid thereon along with the respective place of supply (POS). Table 11B captures adjustment of tax paid on advance received and reported in earlier tax periods against invoices issued in the current tax period. The details of information relating to advances would be submitted in Table 11A only if the invoice has not been issued in the same tax period in which the advance was received. Whereas adjustments made in respect of advances received during the earlier tax period, but invoices issued in the current tax period would be reflected in Table 11B.