Taxpayer wrongly availed ITC of 16.95 Cr due to server error

M/s Nagpal Auto Industries has availed CGST and SGST credit of 16,948/- and Rs 16,94,76,948/- respectively in the month of July 2017 due to server error, later the party has reversed the said ITC taken by mistake in the month of December 2017 as output SGST.

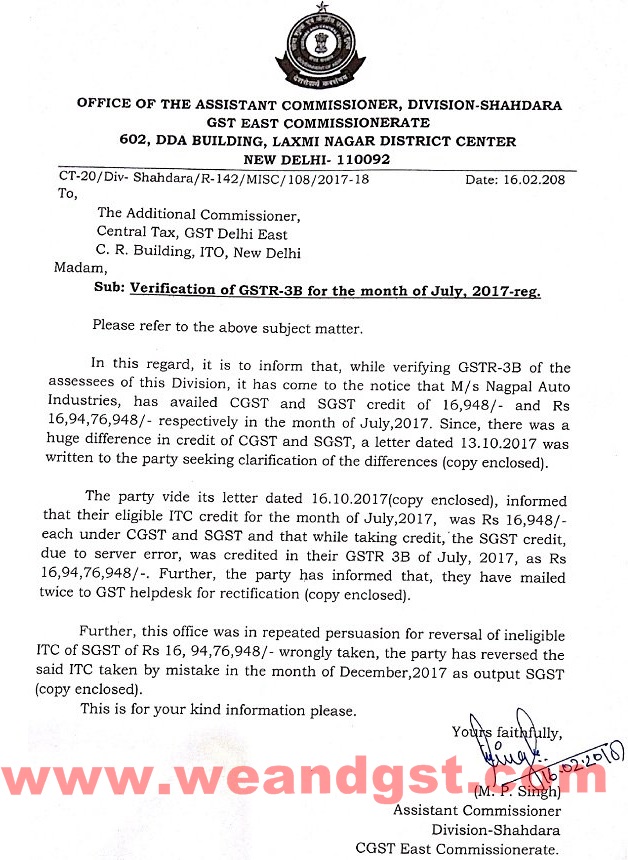

the below mention letter has revealed the mistake.

OFFICE OF THE ASSISTANT COMMISSIONER, DIVISION- SHAHDARA

GST EAST COMMISSIONERATE

602, DDA BUILDING, LAXMI NAGAR DISTRICT CENTER

NEW DELHI- 110092

CT-20/ Div- Shahdara/ R-142/ MISC/ 108/2017-18

Date: 16.02.2018

To,

The Additional Commissioner,

Central Tax, GST Delhi East

C.R. Building, ITO, New Delhi

Madam,

Sub: Verification of GSTR–3B for the month of July, 2017-Reg.

Please refer to the above subject matter.

In this regard, it is to inform that, while verifying GSTR-38 of the assessees of this Division, it has come to the notice that M/ s Nagpal Auto Industries, has availed CGSTand SGST credit of 16,948/- and Rs 16,94,76,948/- respectively in the month of July 2017. Since, there was a huge difference in credit of CGST and SGST, a letter dated 13.10.2017 was written to the party seeking clarification of the differences (copy enclosed).

The party vide its letter dated 16.10.2017 (copy enclosed), informed that their eligible ITC credit for the month of July 2017, was Rs 16,948/ each under CGST and SGST and that while taking credit, the SGST credit, due to server error, was credited in their GSTR 38 of July 2017, as Rs 16,94,76,948/-. Further, the party has informed that, they have mailed twice to GST help desk for rectification (copy enclosed).

Further, this office was in repeated persuasion for reversal of ineligible ITC of SGST of Rs 16,94,76,948/- wrongly taken, the party has reversed the said ITC taken by mistake in the month of December 2017 as output SGST (copy enclosed).

This is for your kind information, please.

Yours faithfully,

(M. P. Singh)

Assistant Commissioner

Division- Shahdara

CGST East Commissionerate.