Haryana One Time Settlement Scheme 2025

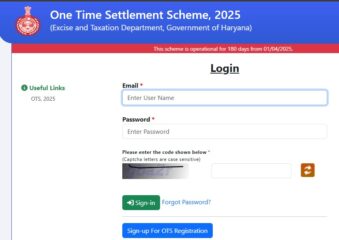

Reading Time: 6 minutesHaryana One Time Settlement Scheme 2025, The Haryana government has introduced the Haryana One Time Settlement Scheme for Recovery of Outstanding Dues, 2025 (OTS-2025), a significant initiative aimed at providing relief to traders, small shopkeepers, and businesses burdened by pending tax liabilities from the pre-GST era. Launched on March 23, 2025, by Chief Minister Nayab Singh

Read More