GST on Sale of Used Cars in India: Key Regulations and Insights

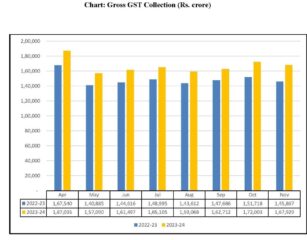

Reading Time: 3 minutesGST on Sale of Used Cars The Goods and Services Tax (GST) regime in India, introduced on July 1, 2017, significantly impacted various industries, including the automobile sector. The sale of used cars has drawn particular attention under GST because of its evolving tax structure. Initially, used cars were subjected to the same tax slabs

Read More