Income Tax officials’ access to personal data , Government clarified in the Rajya Sabha that Income Tax (IT) officials are not permitted to access personal emails, social media, or bank accounts of all assesses. However, under Section 132 of the Income Tax Act, 1961, authorized officers can inspect books of accounts or electronic records during search and seizure operations.

the government has reassured taxpayers that Income Tax (IT) officials are not authorized to access personal emails, social media accounts, or bank accounts. This clarification was made in the Rajya Sabha, addressing concerns about privacy and data protection.

Exceptions for Investigation Purposes

However, under Section 132 of the Income Tax Act, 1961, authorized IT officers can inspect books of accounts and electronic records during search and seizure operations. This provision allows officials to access financial records and documents relevant to tax investigations.

Proposed Income-tax Bill, 2025

Similar provisions are included in the proposed Income-tax Bill, 2025, under Section 247. In cases where access codes to computer systems are unavailable and the concerned person is uncooperative, authorized officers may override the access code to gain access to relevant records.

Protection of Personal Privacy

The government emphasized that these measures are designed to ensure compliance during investigations and do not intend to infringe on personal privacy. Personal communication and unrelated digital accounts remain outside the purview of IT officials’ access.

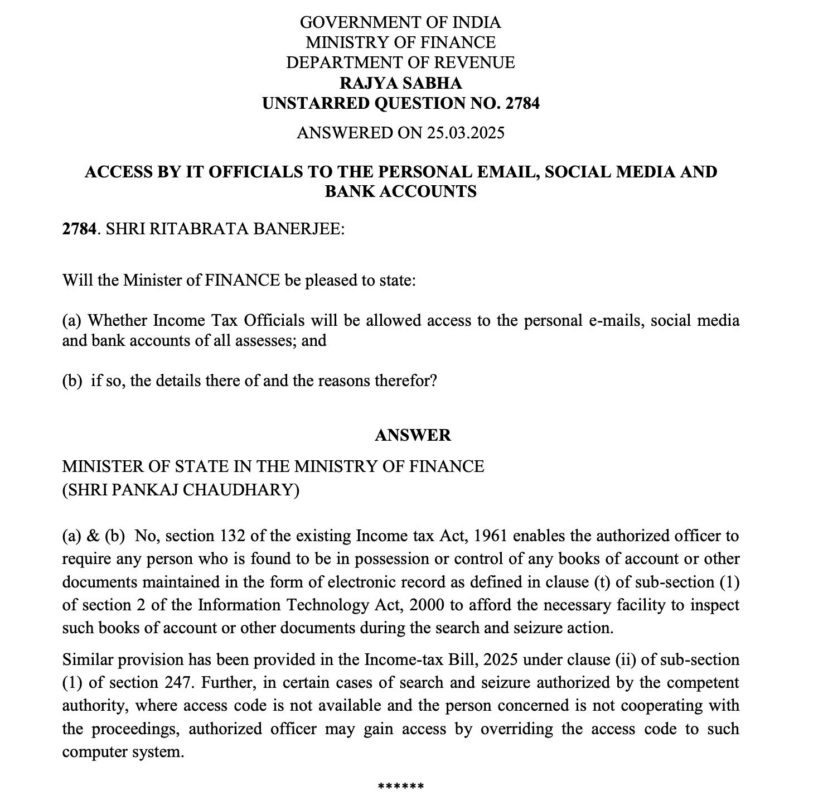

GOVERNMENT OF INDIA

MINISTRY OF FINANCE

DEPARTMENT OF REVENUE

RAJYA SABHA

UNSTARRED QUESTION NO. 2784 ANSWERED ON 25.03.2025

ACCESS BY IT OFFICIALS TO THE PERSONAL EMAIL, SOCIAL MEDIA AND BANK ACCOUNTS

2784. SHRI RITABRATA BANERJEE: Will the Minister of FINANCE be pleased to state:

(a) Whether Income Tax Officials will be allowed access to the personal e-mails, social media and bank accounts of all assesses; and

(b) if so, the details there of and the reasons therefor?

ANSWER MINISTER OF STATE IN THE MINISTRY OF FINANCE

(SHRI PANKAJ CHAUDHARY)

(a) & (b) No, section 132 of the existing Income tax Act, 1961 enables the authorized officer to require any person who is found to be in possession or control of any books of account or other documents maintained in the form of electronic record as defined in clause (t) of sub-section (1) of section 2 of the Information Technology Act, 2000 to afford the necessary facility to inspect such books of account or other documents during the search and seizure action.

Similar provision has been provided in the Income-tax Bill, 2025 under clause (ii) of sub-section (1) of section 247. Further, in certain cases of search and seizure authorized by the competent authority, where access code is not available and the person concerned is not cooperating with the proceedings, authorized officer may gain access by overriding the access code to such computer system.