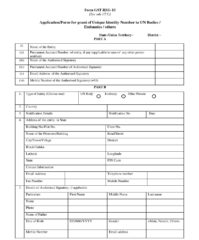

Empowered State Tax officers for Processing & grant of Refund

Reading Time: 2 minutesCBEC cross-empower State Tax officers for processing & grant of GST Refund [To be published in the Gazette of India, Extraordinary, Part II, Section 3, Sub-section (i)] Government of India Ministry of Finance Department of Revenue Central Board of Excise and Customs Notification No. 39/2017 – Central Tax New Delhi, the 13th October, 2017 G.S.R….(E).-

Read More