Reporting Values in Table 3.2 of GSTR-3B

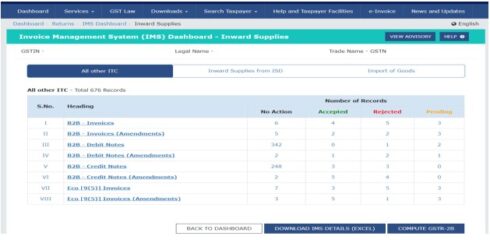

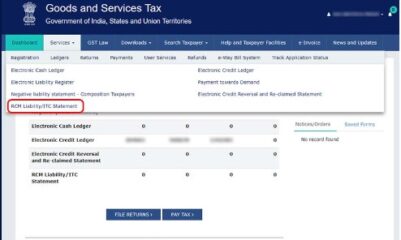

Reading Time: 2 minutesReporting Values in Table 3.2, On April 11, 2025, the Goods and Services Tax Network (GSTN) issued an advisory to clarify the reporting of inter-state supplies in Table 3.2 of Form GSTR-3B, effective from the April 2025 tax period. This update aims to streamline compliance for composition taxpayers and UIN holders by auto-populating data from

Read More